To better understand how content sellers are managing content performance data today, SymphonyAI commissioned Parks Associates to conduct a comprehensive and objective study.

Their research team surveyed more than 45 senior media executives in C-suite, VP, and Director roles at media organizations across the industry, asking questions like:

- What content performance metrics, advertising, or viewer engagement data do you currently have access to? Which data would be “very useful” to your business?

- How are you currently tracking data across multiple distribution partners?

- How will your organization make use of AI tools in 2024/25?

- What are the biggest challenges your company faces in general this year?

The study yielded both fascinating quantitative data and enlightening quotes, revealing the biggest challenges and opportunities for media executives when it comes to managing media data in 2024.

The complete survey results and insights can be found in the newly released white paper: 2024 State of the Market | Streaming Content Performance: Executive Insights.

Keep reading for a sneak peek at five of the top insights from this groundbreaking study.

1) Content sellers are struggling to access content performance data

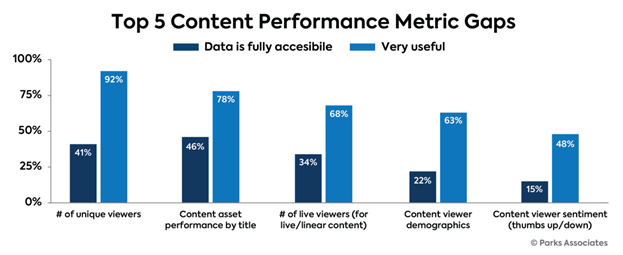

Parks Associates asked media executives to rate 12 content performance metrics according to perceived usefulness and how accessible those metrics were for decision-makers inside the business.

The research team then identified five content performance metrics where large gaps existed between perceived usefulness and data accessibility. For example, 92% of media executives said that it would be very useful to know the number of unique viewers for each piece of content, but just 41% said they currently had full access to this data.

Parks Associates identified significant gaps between the data media executives want and the data they can access. (Source)

These content performance metric gaps indicate that while media executives often know which data can help them make better decisions, they often cannot obtain the OTT data. This makes it challenging for media executives to truly understand how their content is performing across OTT platforms.

2) More detailed viewership data can help content sellers generate more revenue

Parks Associates asked media executives which viewer engagement metrics they would consider very useful for business decision-making and which metrics they had access to on a regular basis.

As with content performance data, significant gaps appeared between the data media executives wanted and what they could actually access.

For example: 93% of media executives said it would be very useful to see a breakdown of total watch time by title, but just 50% of media executives surveyed had access to this data.

Better access to viewer engagement data would allow content sellers to know which types of content resonate with specific audiences and tailor their content production and distribution strategies accordingly.

“We have a publisher portal where we can track viewership. For our publishers who have programs only viewed via the subscription service, they have a record of every single view, and where it’s from and what platform they watched it on. So, we are giving back to the content owners. You pay them based on the number of viewers they get each month, so they are motivated to improve the viewership.” – Co-founder and Chief Operating Officer, Streaming Platform and Content Aggregator

3) Content sellers are eager for advertising-related data

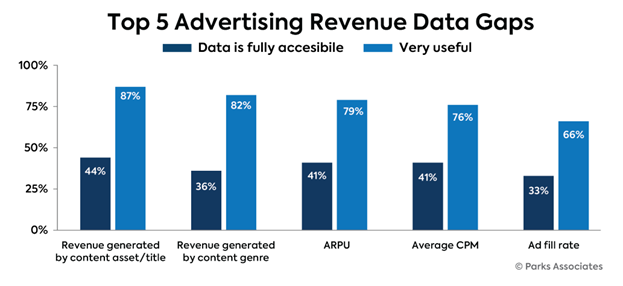

Now that OTT media is shifting toward an ad-based streaming model, content sellers are hungry for access to detailed advertising data.

This is especially true for the growing number of content sellers who sell ad slots in their FAST channel feeds and need to understand more about ad revenue and performance as it relates to individual pieces of content.

But as the media executives in the study shared, most content sellers receive aggregated revenue reports from OTT distributors and don’t have access to the detailed metrics needed to truly understand and optimize advertising revenue. For example, 87% of media executives said it would be very useful to have a breakdown of ad revenue by content asset, but just 44% had access to this data.

Parks Associates identified advertising revenue metrics that content sellers say would help them optimize content distribution, drive more ad revenue, and make better business decisions. (Source)

Sharing granular advertising data can be a win for both OTT streaming platforms and content sellers. When content sellers can use granular ad revenue data to inform content acquisition and distribution decisions, platforms also benefit from the increased viewer engagement and revenue sharing.

4) Content sellers today depend on outdated processes to track data across distribution partners

Parks Associates asked media executives about the specific methods their organizations use to track data across distribution partners. Their responses revealed that most content sellers today are using legacy technologies and outdated techniques to keep track of their data.

![]()

A staggering 68% of media executives said their companies evaluate content performance data from each service or platform separately – effectively stating that they had limited capabilities to aggregate content performance data from multiple sources into a centralized database. This data point highlights the need for products like Revedia that can automate the process of ingesting and normalizing OTT platform data into a centralized repository.

5) Content sellers plan to address business challenges with AI

Large streaming platforms like Netflix and Amazon Prime Video are already leveraging AI-driven applications to drive content recommendations and deliver personalized user experiences. This study reveals that content sellers in 2024 are also looking for innovative ways to implement artificial intelligence.

Parks Associates asked participating media executives about their plans to use AI-driven applications to overcome operational challenges, streamline core operational processes, and optimize business decision-making. The most common responses included generating content recommendations for audiences, financial modeling, and making smarter content acquisition/production decisions.

If we don’t start using it [AI], we’re probably going to be left behind. It can be useful for setting ad breaks and AdWords, building out EPGs, etc. There are so many opportunities just with curation. It would be helpful, especially when we are trying to push certain content. – Director, Streaming Content Owner

Get the latest insights on the state of content performance data

Looking for more insights into the state of media data?Watch SymphonyAI Media Division President Mark Moeder and Parks Associates’ Vice President of Research discuss the top findings in the webinar “2024 State of Content Data” or download the full white paper.

The full 18-page report includes additional data, insightful quotes, and industry analysis such as:

- A chart displaying the top 8 challenges that media executives expect to face over the next two years.

- How media executives are striking a balance between D2C and third-party content distribution.

- The three factors that are pushing the media industry towards collaboration and consolidation (and what it means for media companies).

- How consumers’ average number of OTT service subscriptions has changed in the last 7 years.