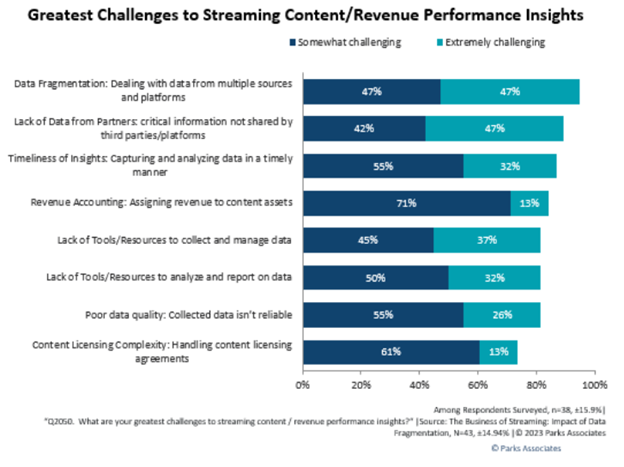

In a recent study on the state of media data, researchers asked industry executives to identify their greatest challenges around understanding their content revenue and performance.

Their responses provide a fascinating perspective on the primary obstacles content sellers face when it comes to extracting insights from the streaming data they receive from OTT platforms.

This article takes a closer look at eight of the greatest challenges to content revenue and performance insights and three ways content sellers can overcome them.

8 challenges to content revenue and performance insights

1) Data fragmentation

The number one issue highlighted by media executives was data fragmentation. The rapid spread of OTT platforms increases revenue opportunities for content sellers but complicates analysis as content sellers must deal with numerous data sets.

60% of content sellers are distributing across 10+ streaming platforms and 24% are distributing across 20+ streaming platforms.

The streaming data content sellers receive is non-standardized and typically arrives in different formats and at different frequencies from each platform partner.

The disparate nature of this data makes it both time-consuming and costly for content sellers to ingest, normalize, and analyze. Nearly half of the media executives surveyed said that data fragmentation was making it “extremely challenging” to get insights into content revenue and performance.

2) Lack of data from partners

Once content sellers enter distribution deals with OTT streaming platforms, they often do not receive the data they need to generate content revenue and performance analytics.

Some OTT platforms don’t track this data at all, some are tracking it but don’t have the reporting capabilities needed to share it efficiently, and some see it as a competitive advantage and would rather not share what they know.

Parks Associates’ research illustrates the gap between the content performance data that media executives want and what they can access.

Most OTT streaming platforms share basic metrics like total revenue and viewing time or number of ad impressions, but to truly understand content revenue and performance, content sellers need access to data like:

- Number of unique viewers

- Viewing time by content asset

- Viewer demographics

- Total revenue by content asset/title and genre

- Ad fill rate

47% of media executives surveyed said that critical information not shared by third parties/platforms made it extremely challenging to generate content revenue/performance insights.

3) Timeliness of insights

Following data fragmentation and lack of streaming data access, media executives highlighted the inability to generate timely insights:

“We get data from so many distribution partners, but it all comes on a different schedule and each report is formatted differently. Some are in PDF format and some are spreadsheets. We have teams who manually enter that data into our systems, but it’s a lengthy process. By the time we’ve aggregated and normalized everything for analysis, weeks have gone by and we’ve missed the boat on getting value from those insights.” — C-Suite Media Executive

When aggregation and processing workflows are inefficient, content sellers can’t generate the timely insights they need to make business decisions that positively impact revenue.

4) Revenue accounting

Question: How can content sellers attribute streaming revenue to specific media assets if OTT streaming partners won’t share a breakdown of revenue generated by asset?

Answer: They can’t, so it’s no wonder that 84% of media executives surveyed said revenue accounting (assigning revenue to specific content assets) was either “somewhat” or “extremely” challenging.

In the new Streaming Content Performance: Executive Insights white paper, 87% of media execs said it would be very useful to have a breakdown of advertising-related revenue generated by content asset/title, but just 44% reported having access to this data.

Without accurate revenue accounting, content sellers don’t know which assets are moving the needle on revenue performance, and strategic decision-making to optimize revenue becomes virtually impossible.

5) Lack of data collection and management tools

Digital transformation has been relatively slow in the media industry and most content sellers still rely heavily on manual processes when it comes to aggregating and normalizing data from OTT platforms.

![]()

A majority of content sellers do not have specialized tools to generate an aggregate view of their content performance and revenue data.

Heavily manual data management strategies have historically been viable when content sellers primarily dealt with traditional linear distribution partners, where data was standardized industry-wide and delivered on a uniform schedule. But in the era of platform proliferation and non-standardized reporting, media executives recognize the need for software tools that can help streamline data collection and management tasks.

6) Lack of data analytics and reporting tools

Content sellers need data analytics and reporting capabilities to answer crucial questions about the content and revenue performance of their media assets, including:

- Which distribution partners are bringing in the most revenue?

- What is our forecasted revenue for this month/quarter/year?

- Which content assets are being viewed the most?

- Which content assets are generating the most revenue?

- What is the audience demographic breakdown for each of our content assets?

- What genres of content are attracting the most viewership or revenue?

- Which distribution partner is filling the most ad slots in our programming?

Unfortunately, many media executives said that they lacked the analytics and reporting tools necessary to extract these kinds of insights – even if they had all the data they needed.

7) Poor data quality

When the streaming data is inaccurate, incomplete, inconsistent, unreliable, or outdated, it becomes more challenging for content sellers to extract valuable insights from it.

In this study, 81% of media executives said that data quality issues were making it either “somewhat” or “extremely” challenging to get streaming content/revenue performance insights. This finding further highlights the need for more timely, frequent, and accurate data sharing.

8) Content licensing complexity

Managing content licensing has become increasingly complex for content sellers. In the past, licensing agreements with linear distribution partners were few in number, relatively standardized, and could usually run for a several years with only minor changes.

But in the OTT streaming era, content sellers manage a much greater number of licensing agreements with more complex terms and payment calculations. Shorter-term deals are also more common because OTT platforms want the flexibility to renegotiate based on content performance, release windows, and other factors.

Thus, the process of negotiating for data rights, managing licensing agreements, and auditing for distributor compliance has become increasingly challenging for content sellers.

Media executives identify the 8 greatest challenges to streaming revenue/performance insights.

3 Ways for content sellers to overcome data challenges

1) Negotiate data sharing with OTT distribution partners

Content sellers should bring up data access when entering into OTT licensing agreements. More often than not, you can often negotiate for frequent, high-quality data in spreadsheet format if you make it a priority.

2) Deploy specialized media analytics software

Content sellers need access to powerful media software tools like Revedia that can streamline and automate some of the time-consuming and error-prone tasks associated with data aggregation, normalization, analysis, and reporting.

Revedia is a data intelligence platform purpose-built to streamline data management workflows and solve content revenue/performance insight challenges for content sellers. (Source)

3) Shift the industry towards data standardization

A concerted shift towards standardized data sharing practices (e.g. robust data sharing, consistent data quality, and standard report formatting and frequency across OTT platforms) would help content sellers overcome data quantity/quality and fragmentation challenges.

For more details about the state of media data, download the full white paper Streaming Content Performance: Executive Insights | 2024 State of Media.