KYC AND CUSTOMER DUE DILIGENCE

Protect customers with KYC and CDD SaaS

Uncover risk with SaaS for Know Your Customer (KYC) and Customer Due Diligence (CDD)—and seamlessly integrate into your current stack.

Uncovering risk for global brands

-

50%

Fewer false positives

-

30%

Reduction in manual reviews

-

40%

Faster investigations

Assess risk and remain compliant—regardless of resource limitations

Preventing criminal onboarding is complex, requiring disparate data from internal and external sources to be considered in real-time. SymphonyAI supports investigators with a unified picture of evolving risk—before it becomes problematic.

Enable real-time account opening and risk scoring by eliminating the need for manual processes. SymphonyAI’s solutions create a frictionless user experience.

Outpace regulations and demonstrate compliance with clear and simplified workflows, reporting, and models. SymphonyAI’s solutions evolve with mandates and your risk appetite.

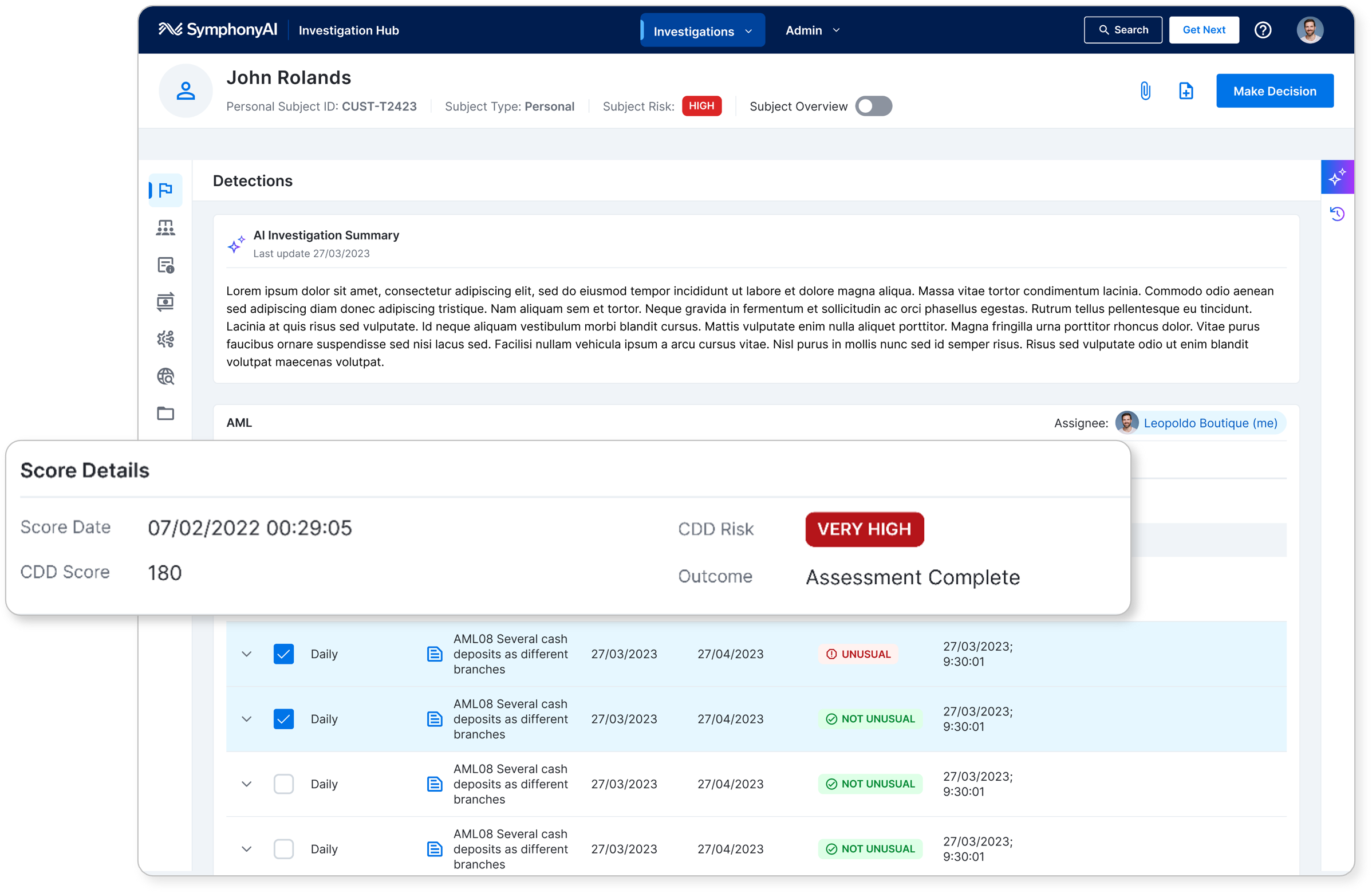

Enable investigators to make concise, confident decisions based on key contextual information. SymphonyAI’s solutions process alerts quickly so no details are overlooked.

Navigate organizational complexities with a cohesive anti-money laundering strategy. SymphonyAI’s solutions support your business with a single, enterprise-wide deployment.

Know Your Customer (KYC) and Customer Due Diligence (CDD) Compliance

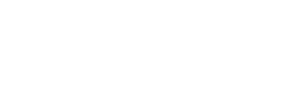

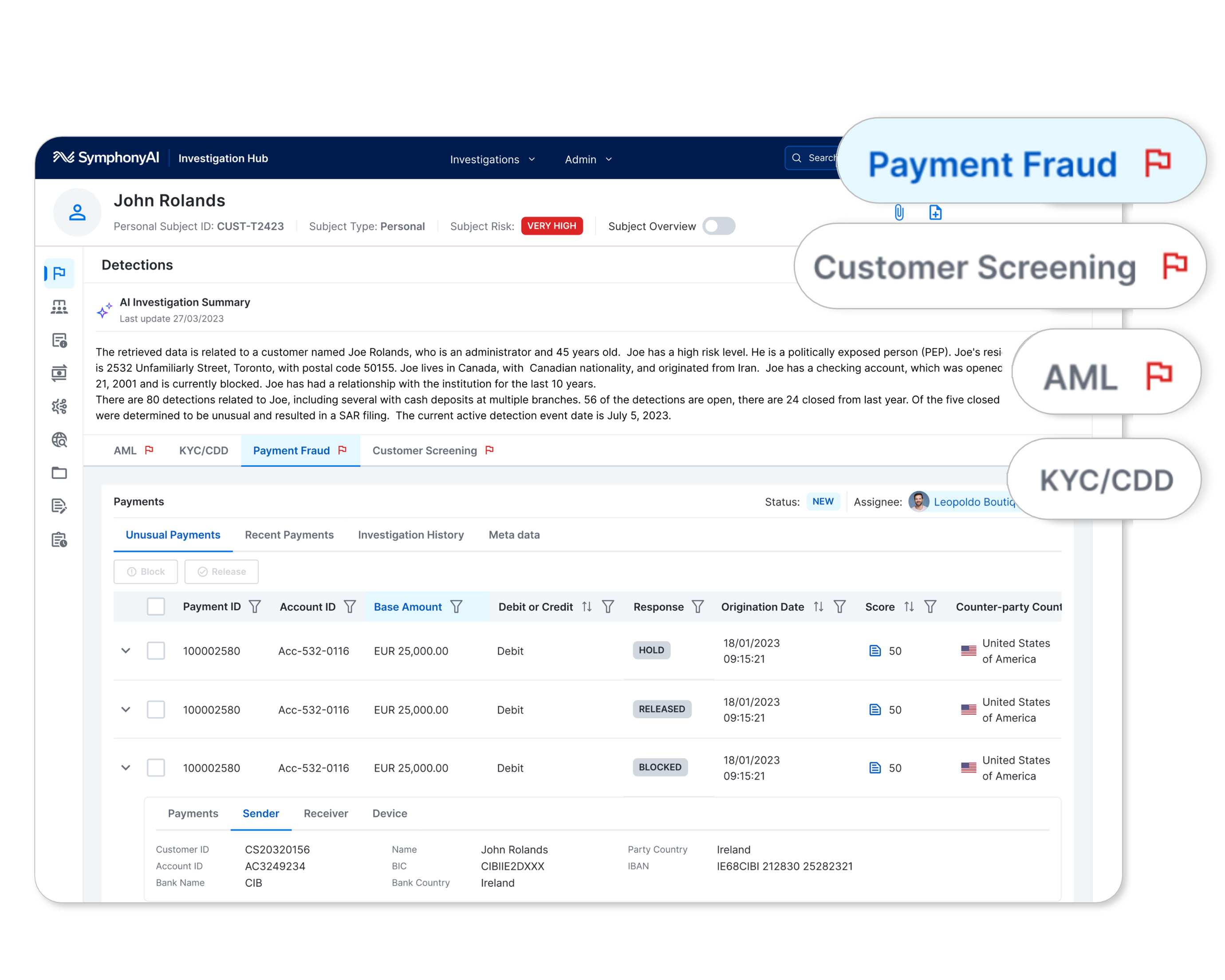

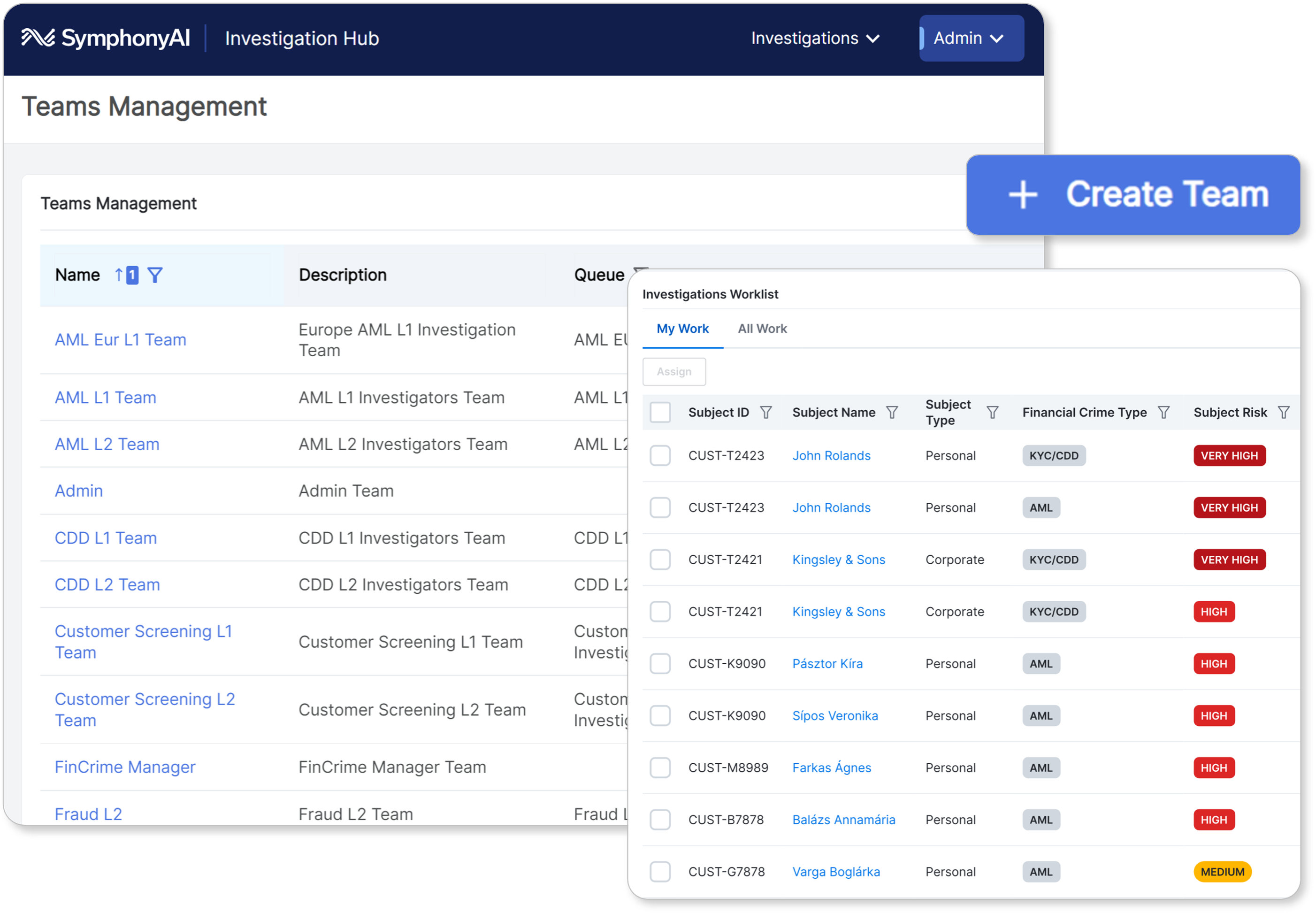

Solve complex financial crime challenges—while creating frictionless customer experiences. NetReveal Customer Due Diligence is an enterprise-wide solution that enables your team to comply with know your customer (KYC) and anti-money laundering (AML) regulations.

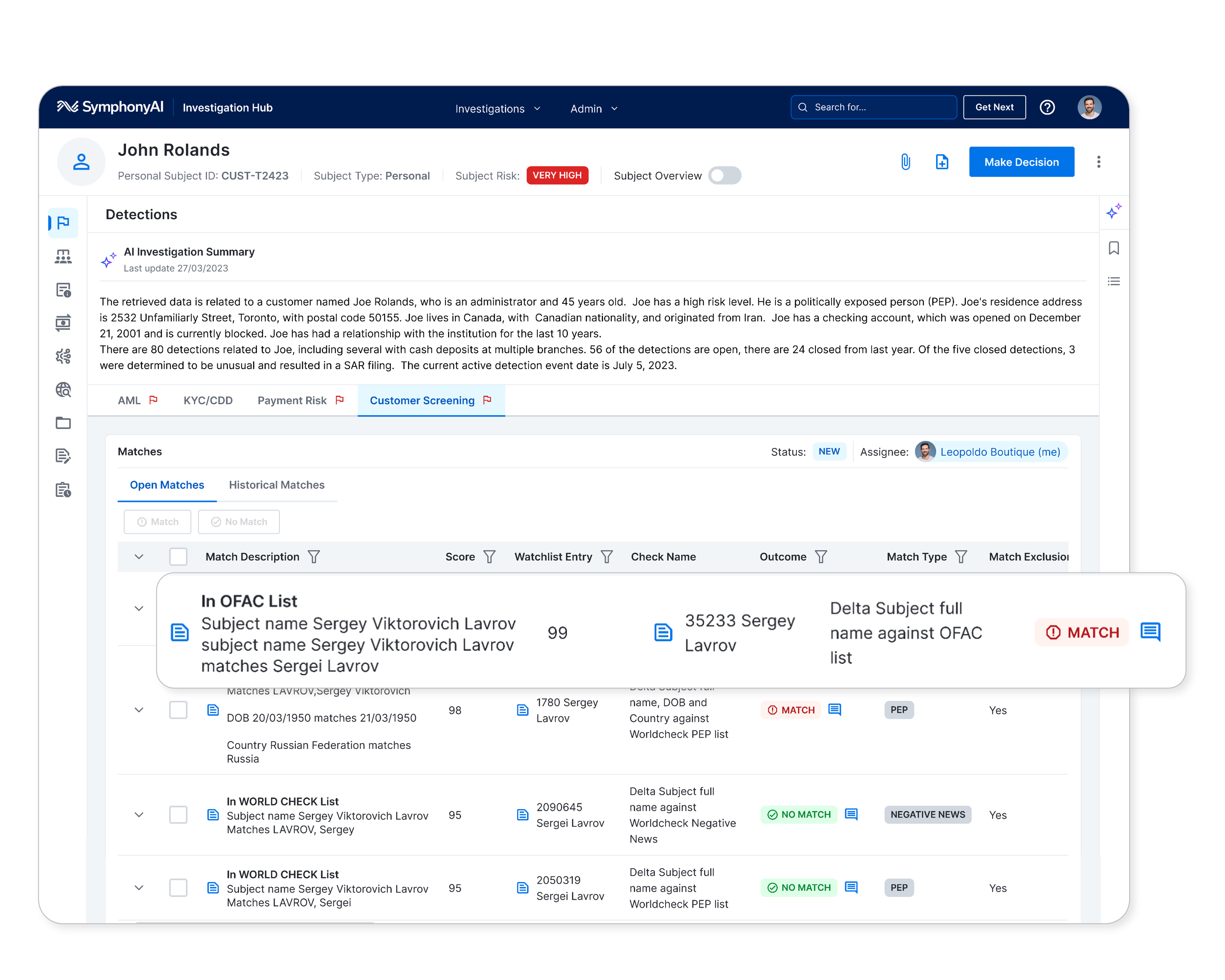

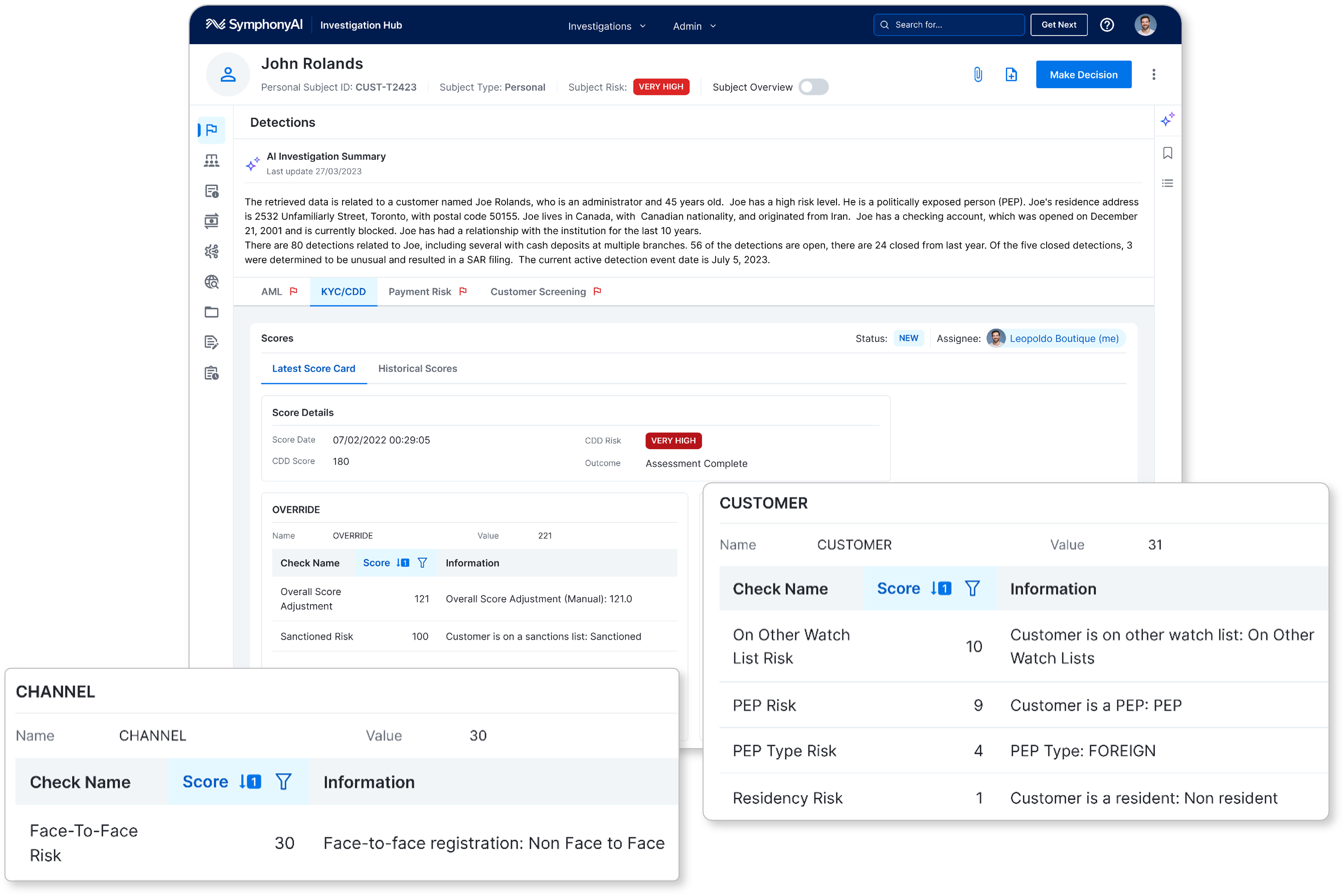

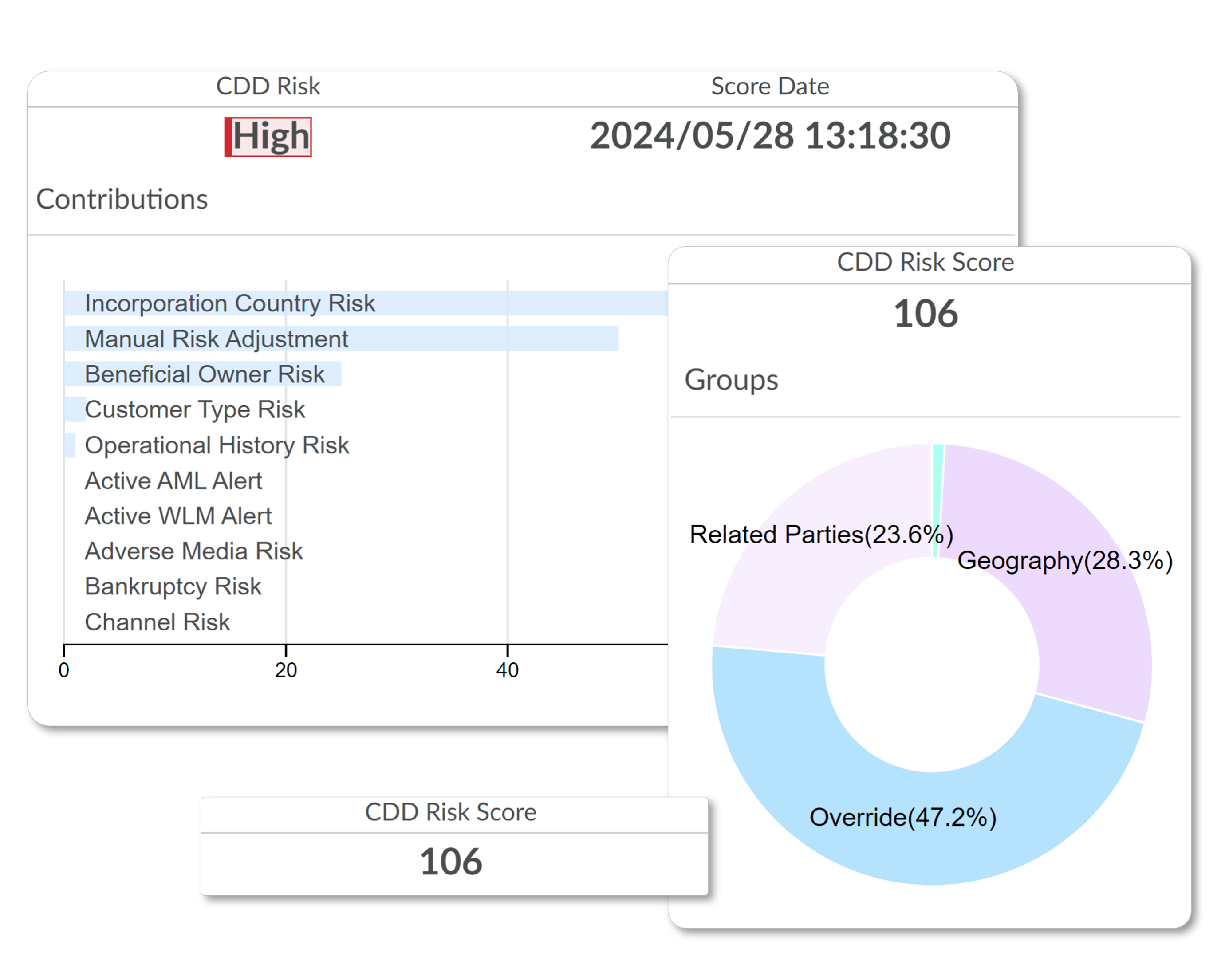

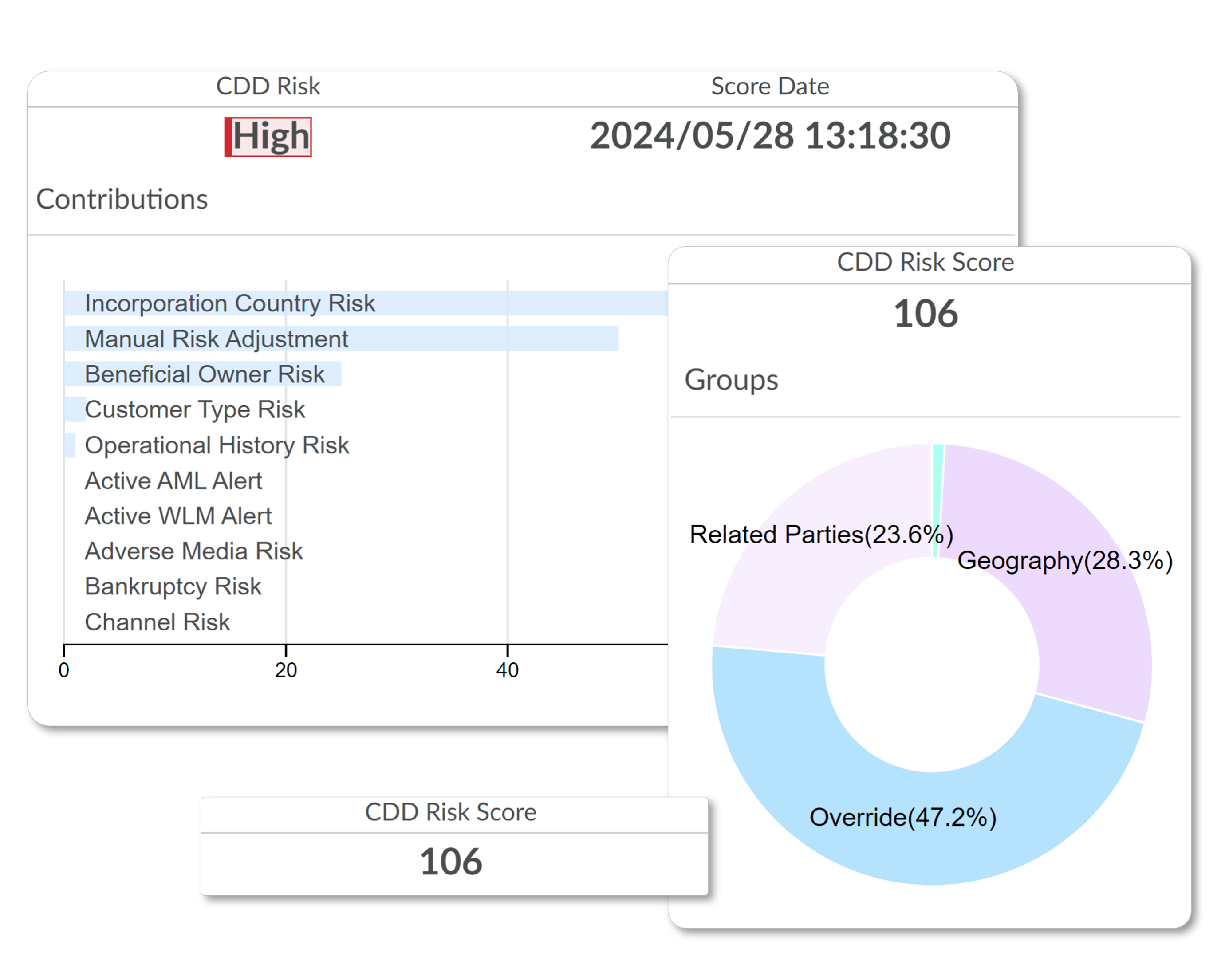

SymphonyAI’s NetReveal Customer Due Diligence solution seamlessly integrates with internal and external data sources to streamline investigations and provide a holistic view of customer risk. Real-time risk assessments enable fully automated onboarding, and with enhanced visibility, investigators can prioritize high-risk alerts.

Solve complex financial crime challenges—while creating frictionless customer experiences. NetReveal Customer Due Diligence is an enterprise-wide solution that enables your team to comply with know your customer (KYC) and anti-money laundering (AML) regulations.

SymphonyAI’s NetReveal Customer Due Diligence solution seamlessly integrates with internal and external data sources to streamline investigations and provide a holistic view of customer risk. Real-time risk assessments enable fully automated onboarding, and with enhanced visibility, investigators can prioritize high-risk alerts.

Innovative AI—unmatched, expert support

Utilize our deep domain knowledge to protect your customers

With 25+ years of experience developing market-leading KYC/CDD transaction monitoring products, SymphonyAI is a partner to the world’s largest financial institutions.

Investigate and understand the full customer lifecycle

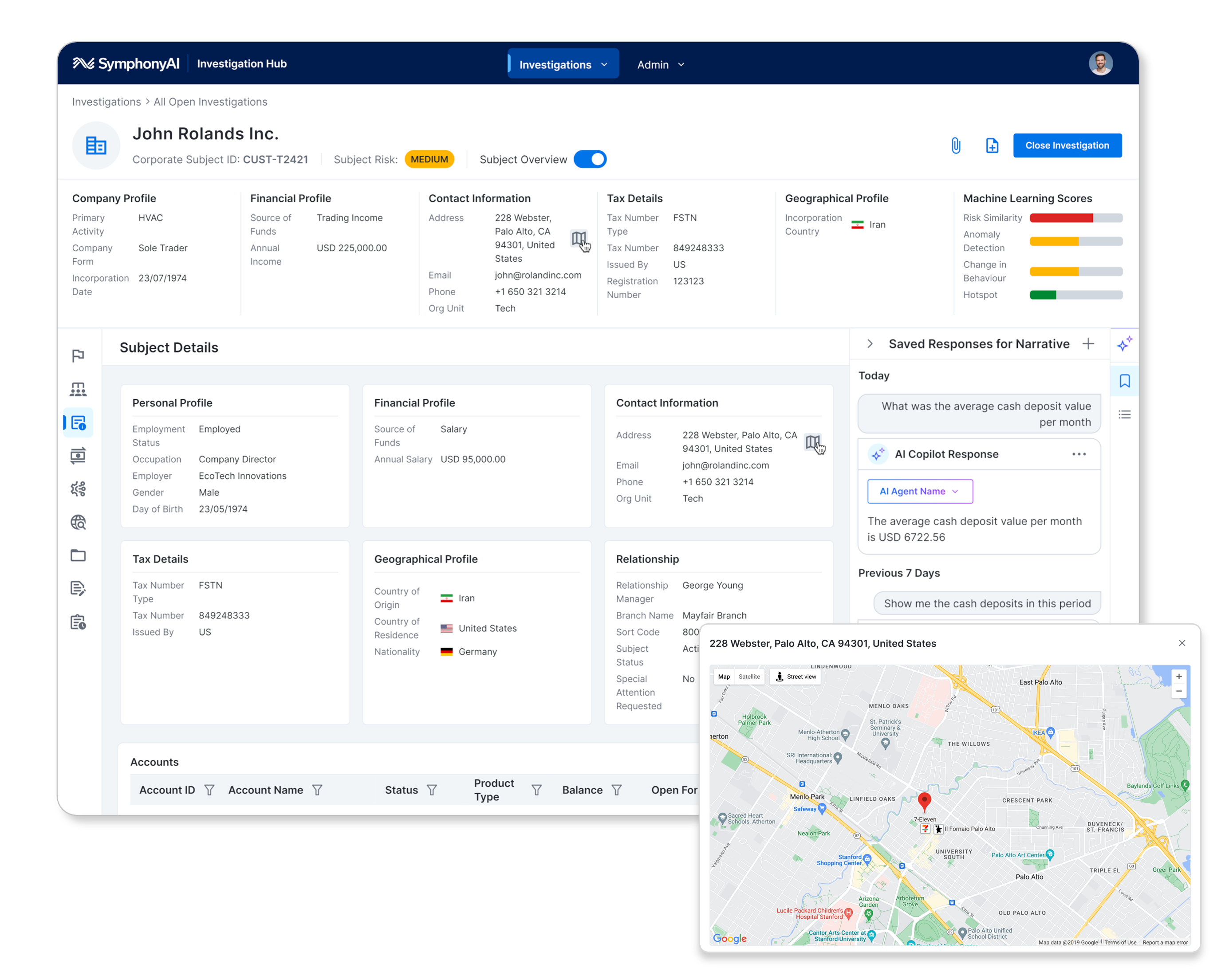

Easily cover the complete customer lifecycle and integrate your data with a single solution for your entire compliance ecosystem.

Transform your capabilities with predictive and generative AI

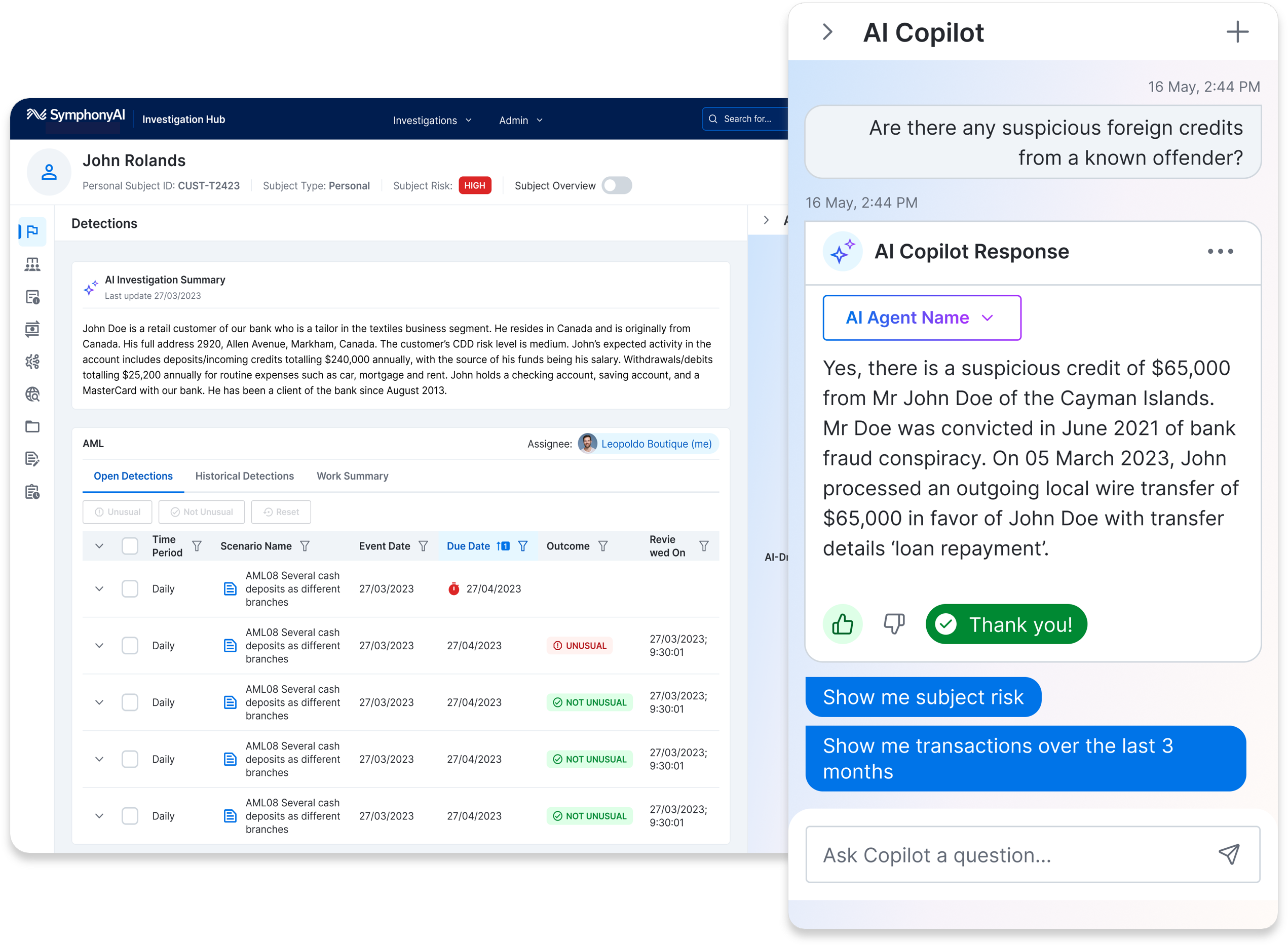

Enhance your detection and investigation capabilities with industry-leading predictive and generative AI, and supervised and unsupervised machine learning.

Connect enterprise-wide units and data in KYC/CDD solutions

Tear down the silos that inhibit investigators with complete, scalable know your customer (KYC) and customer due diligence (CDD) solutions for your entire organization.

Customer success is our success

Industry awards

End-to-end financial crime prevention

Discover the value of SymphonyAI

Optimize KYC and ensure CDD compliance with AI-driven financial crime prevention solutions—backed by support from strategic experts.

KYC and CDD FAQs

The team at SymphonyAI is here to answer your questions about financial crime prevention and our solutions. Here are some of the most common.

SymphonyAI provides AI-powered solutions for KYC and CDD, enabling real-time risk assessments, automated onboarding, and efficient customer risk monitoring.

These solutions reduce false positives by up to 50%, lower manual review requirements by 30%, and accelerate investigations by 40%, giving investigators clearer, faster insights into customer risk.

Banks, insurance companies, financial markets, gaming, and private banking and wealth management can benefit from SymphonyAI’s solutions to stay compliant with AML regulations and efficiently handle high-risk customer management.

By integrating with both internal and external data sources, SymphonyAI provides software that offers a unified view of customer risk, automating onboarding and prioritizing high-risk alerts for immediate attention.

The solution incorporates predictive and generative AI, as well as supervised and unsupervised machine learning, allowing it to adapt dynamically to new risk factors and improve over time.

Clients, including large European banks, have reported millions in annual savings and significant improvements in compliance efficiency through SymphonyAI’s integrated KYC and CDD approach.