KYC CUSTOMER DUE DILIGENCE

Simplify global compliance

Stay one step ahead of ever-changing regulatory requirements

Ongoing compliance

From initial onboarding and monitoring to Enhanced Due Diligence (EDD), access auditable workflows and easily adjustable risk thresholds to align with evolving regulatory mandates.

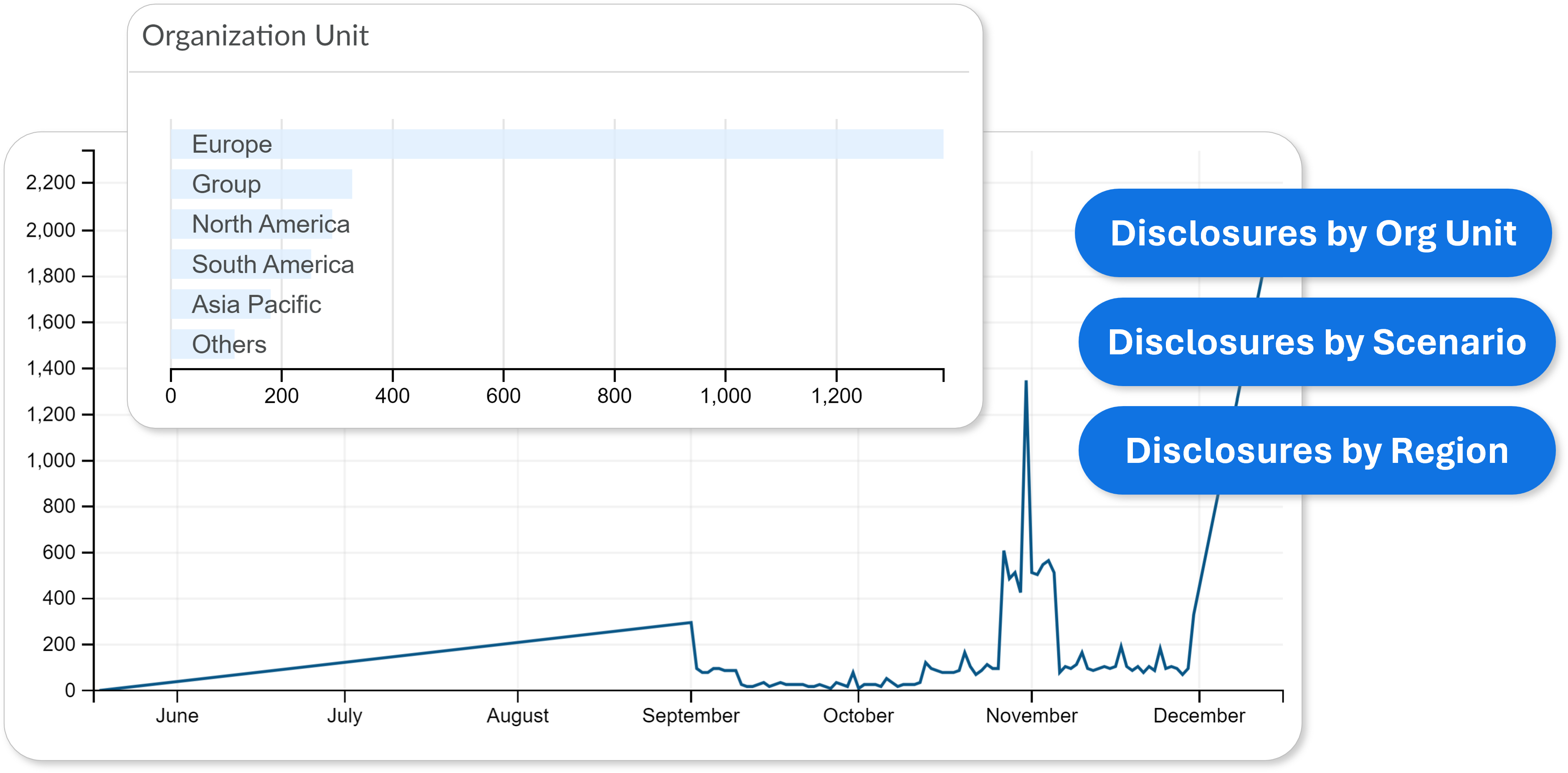

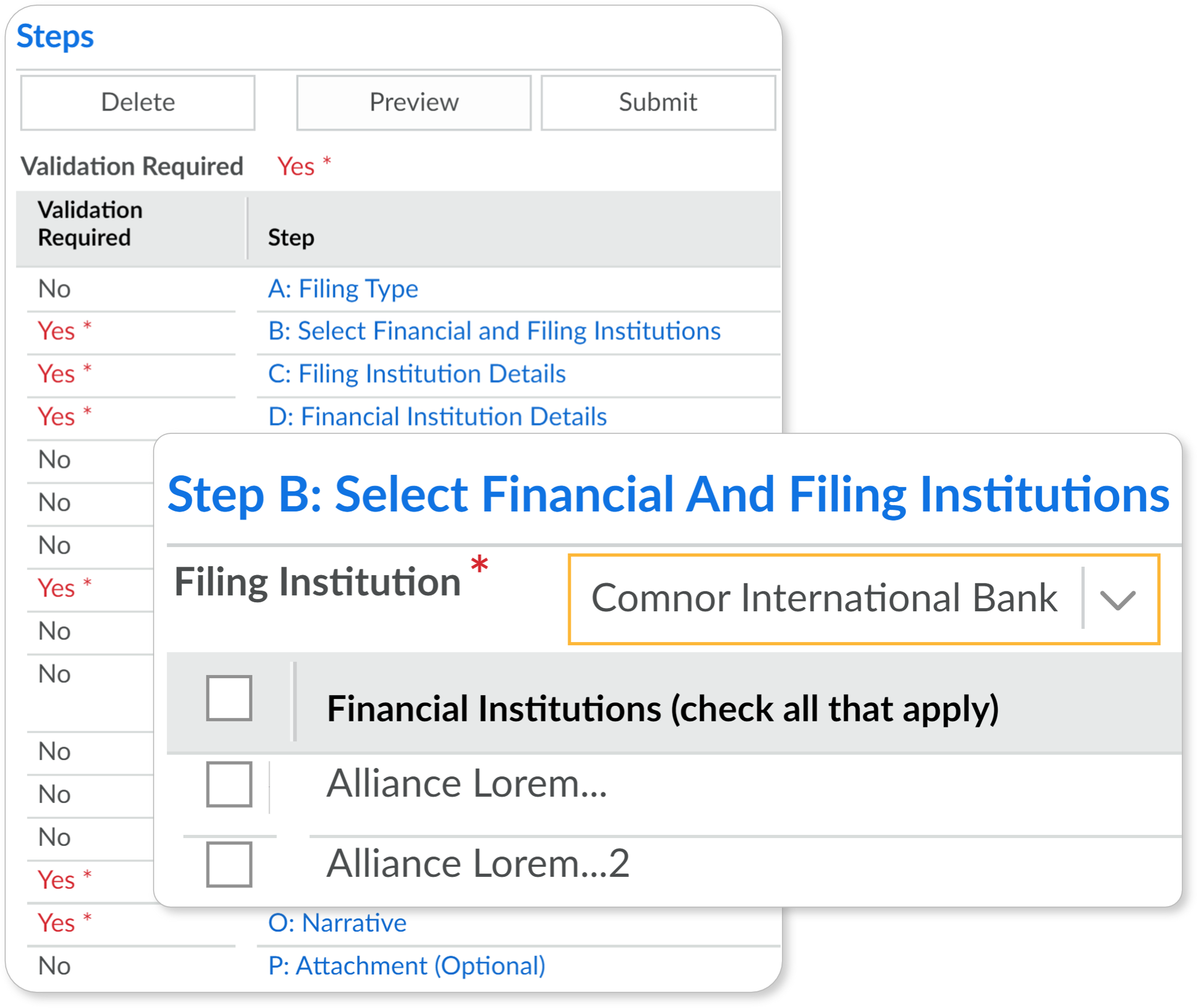

Automate SAR creation

Take the hassle out of disclosures with SAR templates auto-populated with key case information, such as customer details, account and transaction summaries.

Provide superior explainability

Evidence consistent and defendable decision-making with transparent machine learning models that justify actions taken to regulators and auditors.

Discover more features and functionality of NetReveal Customer Due Diligence

Solution benefits

Onboard and detect risk in real-time

Accelerate CDD and automate complex tasks to improve the customer experience.

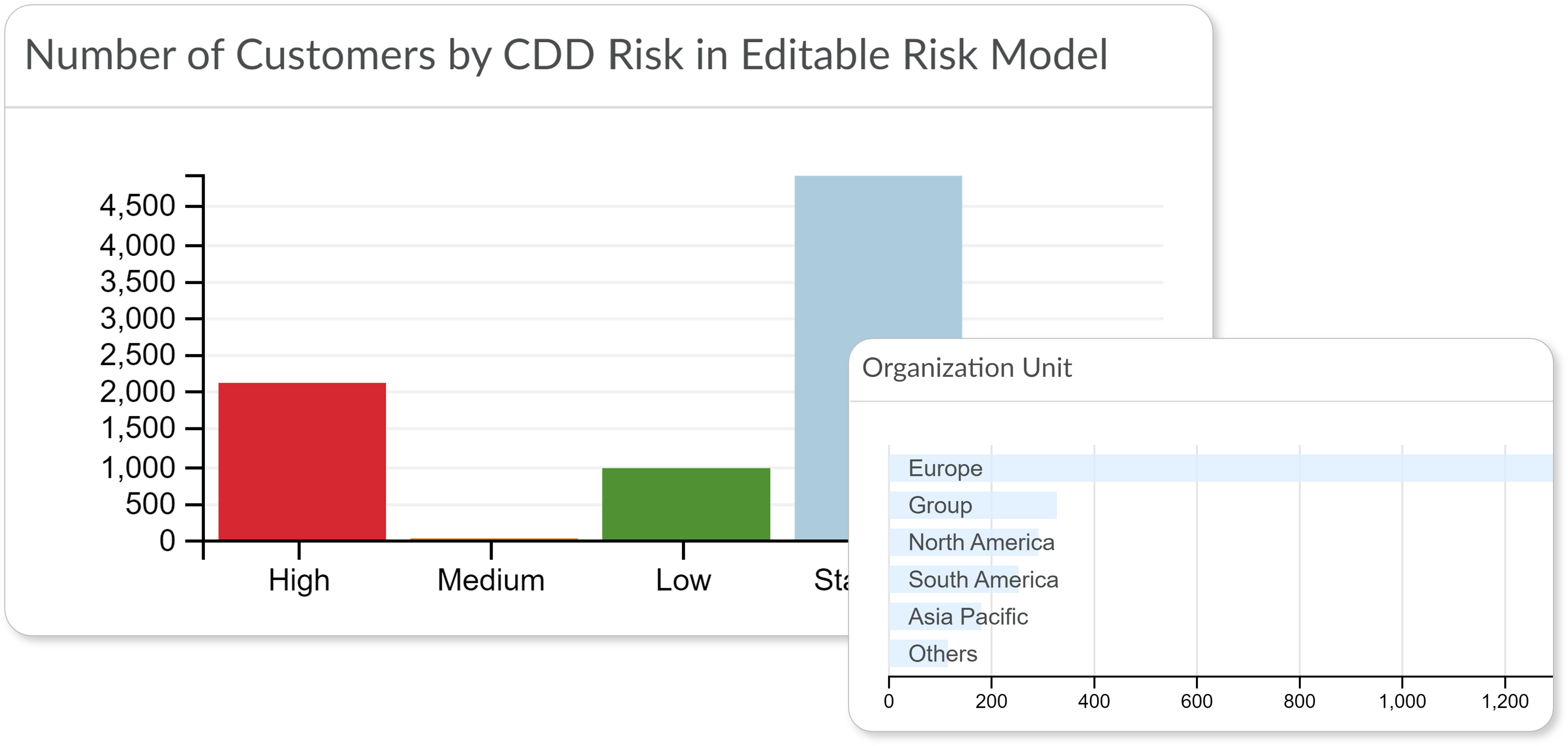

Manage risk intelligently

Consolidate all customer data and gain a single, holistic view of a customer’s risk profile.

Remain compliant

Ensure adherence to ever-evolving regulatory directives and quickly adapt to changing requirements.

Customize with ease

Quickly adjust UBO thresholds to align with regulatory mandates and your risk appetite.