NetReveal KYC / Customer Due Diligence

Redefine risk with intelligence-led KYC/CDD

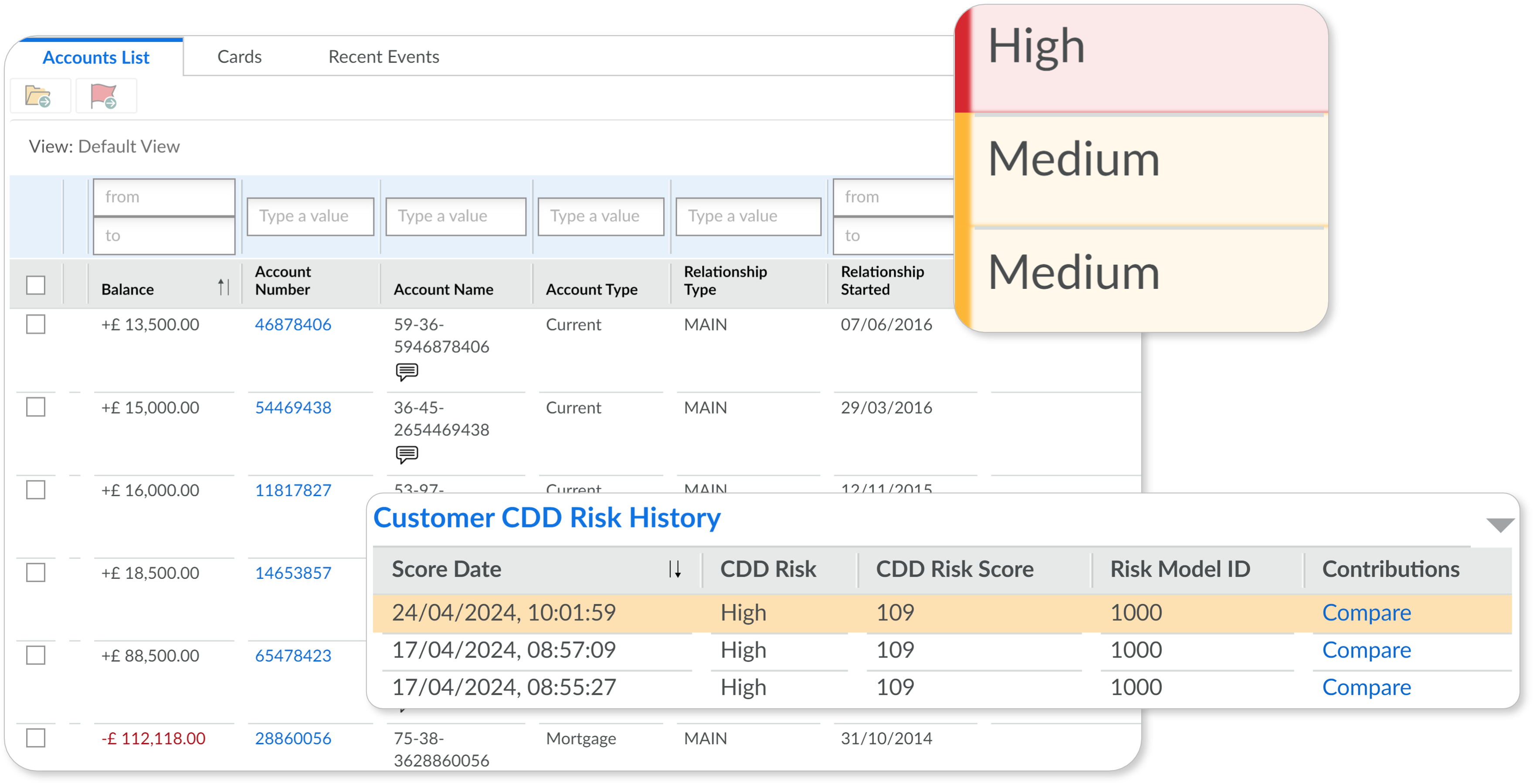

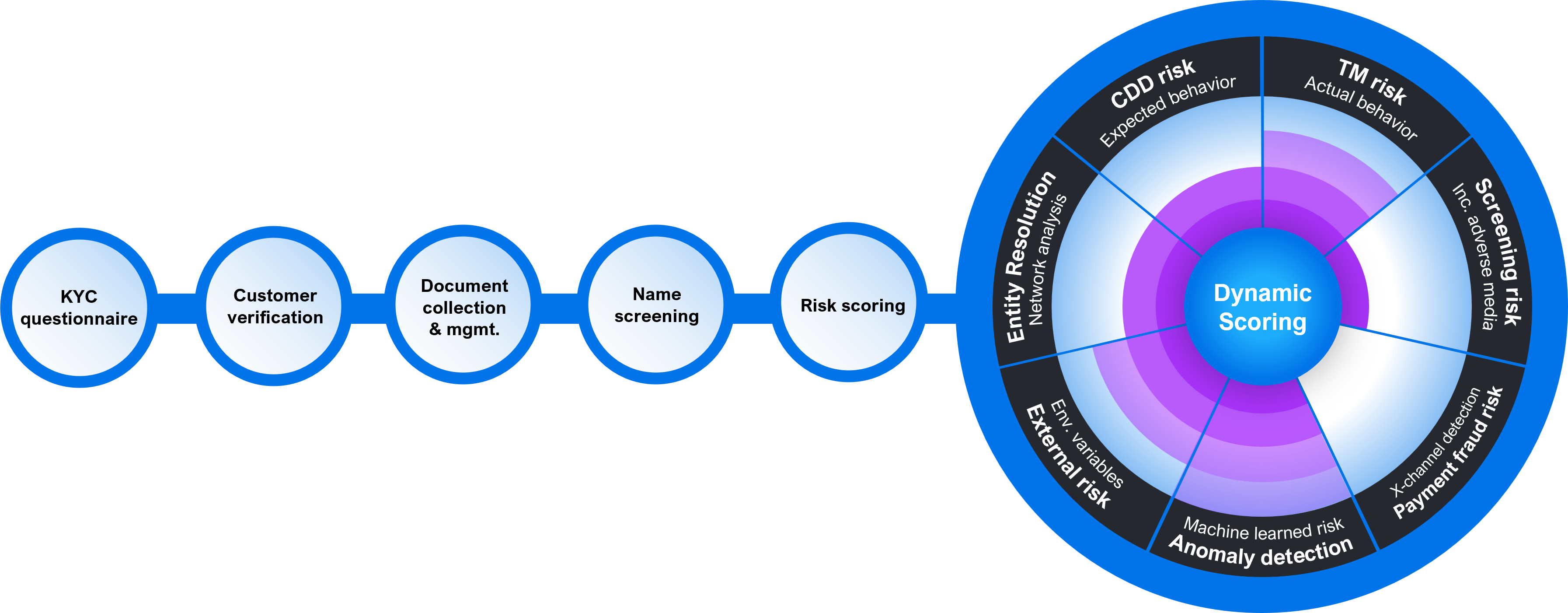

Dynamic risk assessments throughout the customer lifecycle

Make onboarding effortless

Provide a seamless customer experience with real-time risk assessments that enables onboarding to be fully automated.

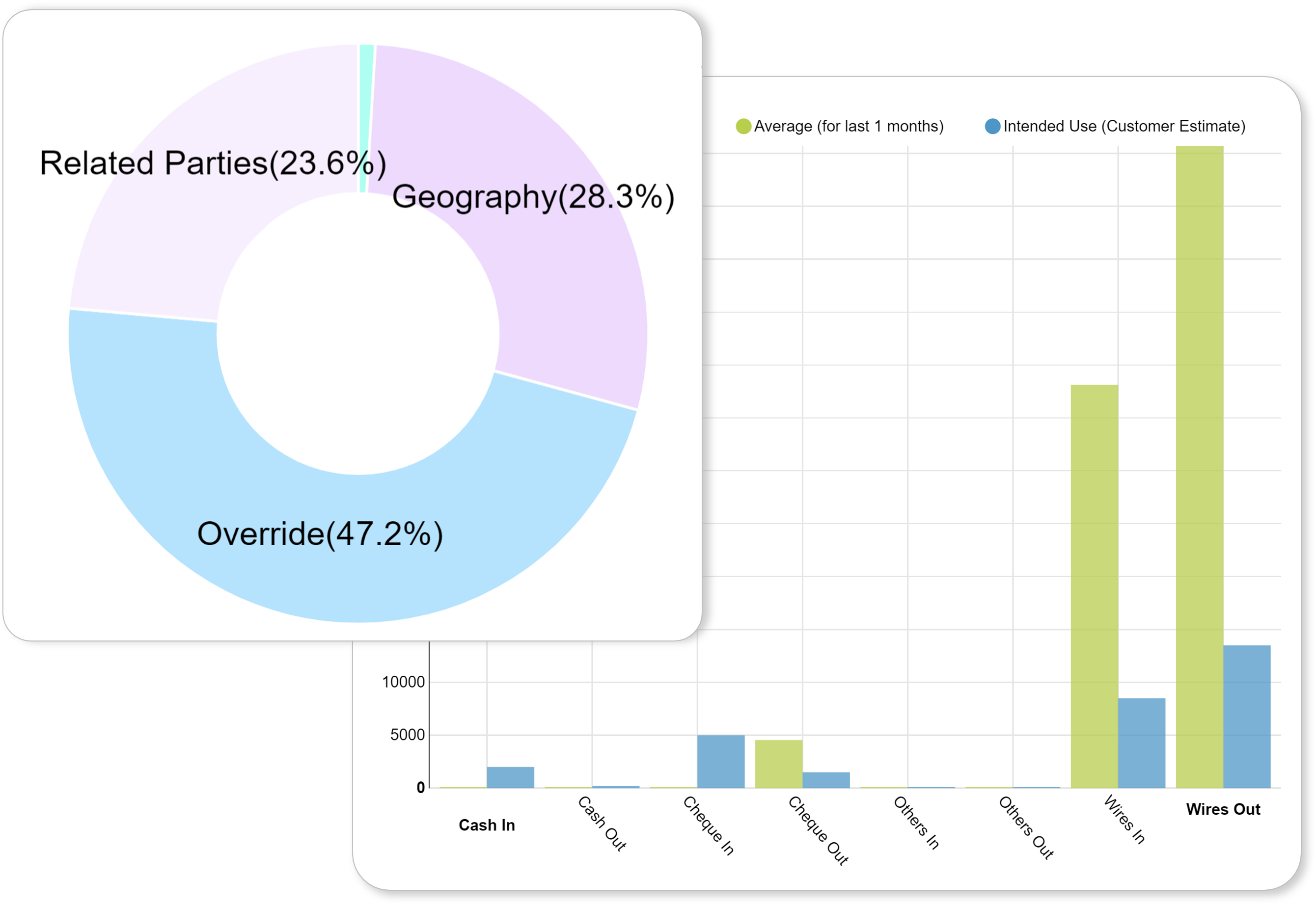

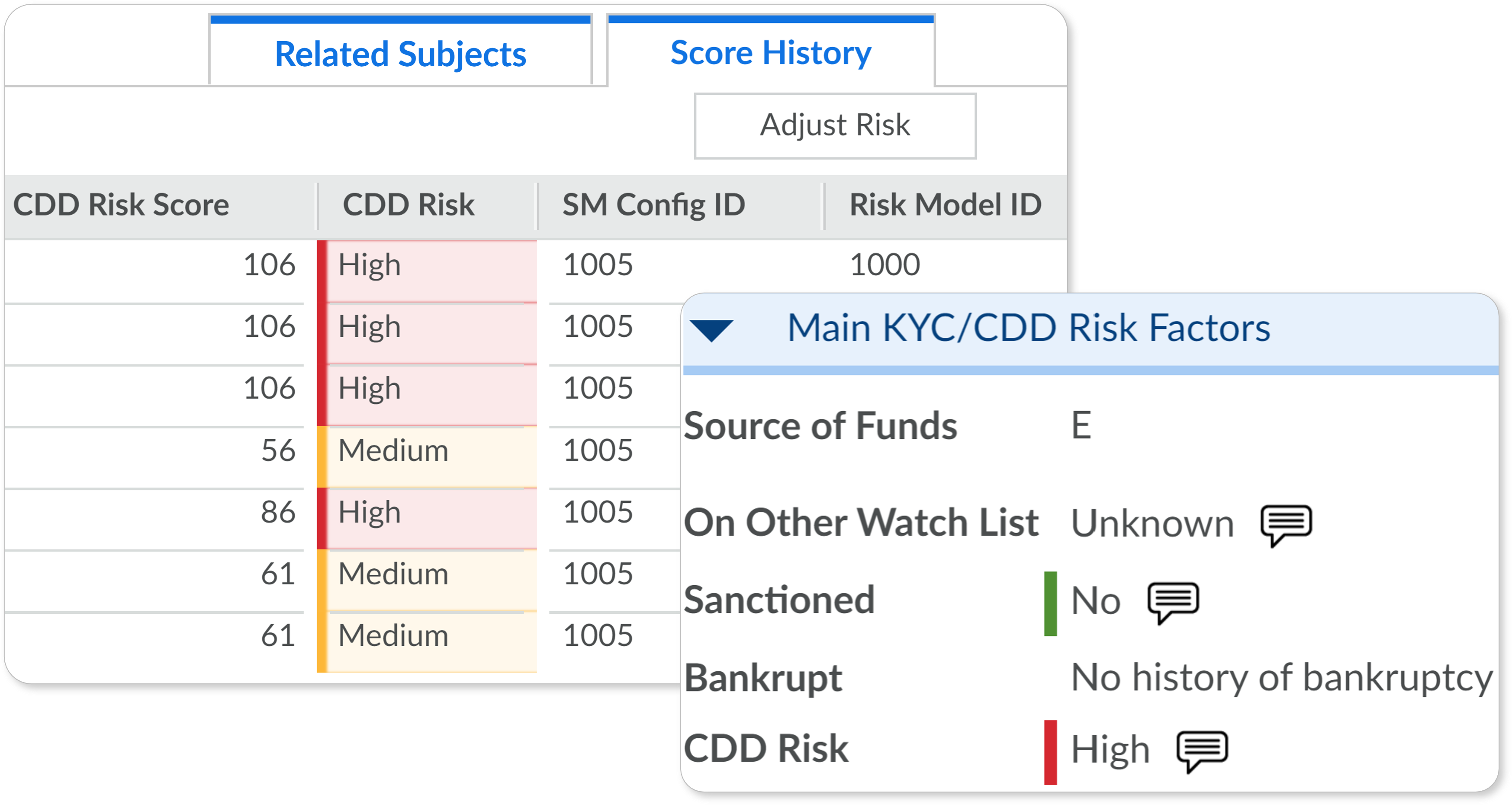

Access holistic risk insights

Connect CDD with Name Screening, Payment Fraud, and AML detection to consolidate risk signals and achieve a complete view of your exposure to risk.

Optimize investigator efficiency

Automate level one triage, prioritize high-risk alerts, and auto-enrich customer data for streamlined, effective investigations.

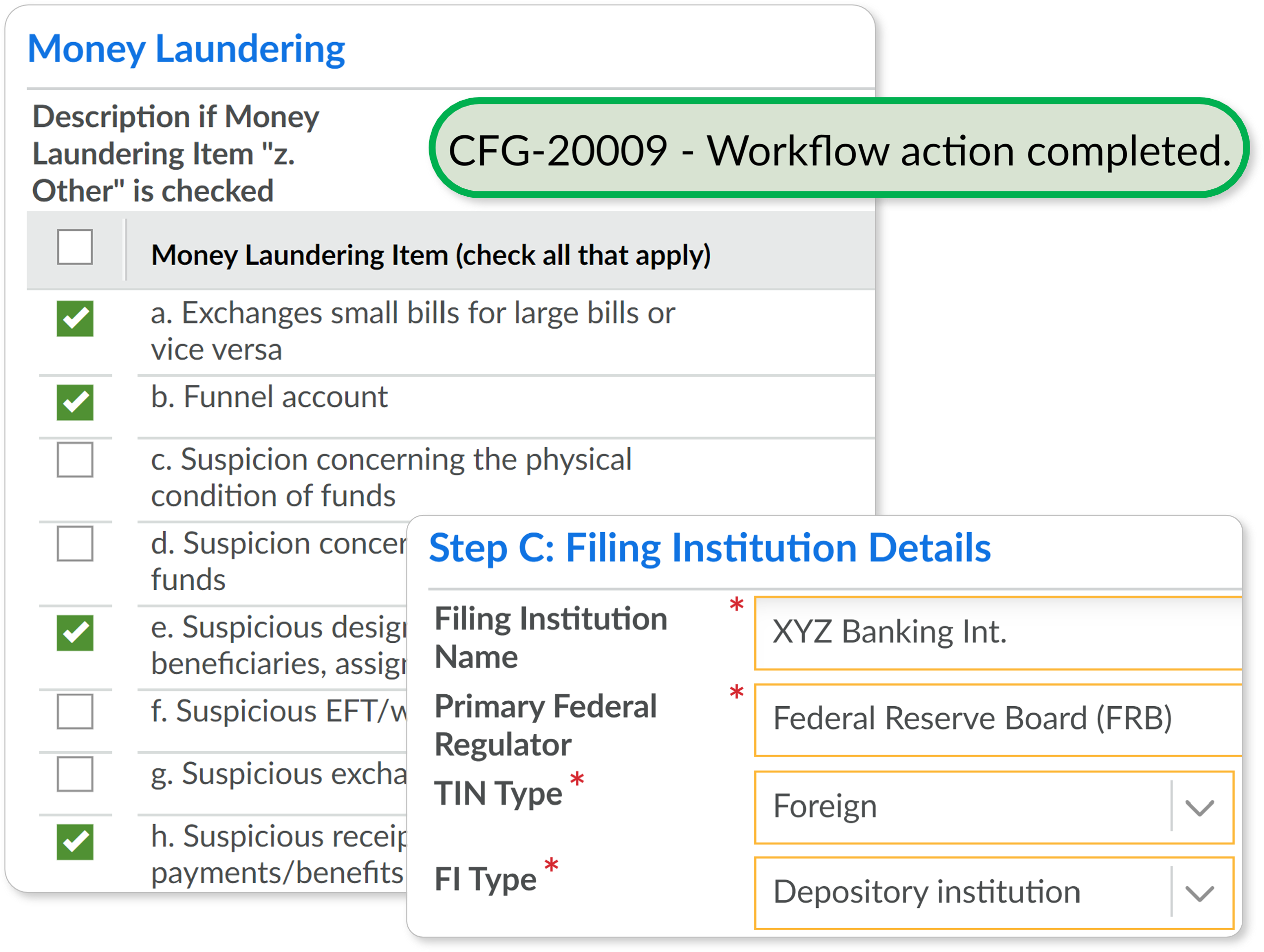

Keep regulators onside

Demonstrate enhanced compliance with easily auditable workflows, transparent models, and automated regulatory reporting.

Say goodbye 👋

to periodic reviews

Start your journey towards Perpetual KYC (pKYC) one step at a time. With SymphonyAI, it’s easier than you think.

Related KYC/CDD resources

Keeping a watchful eye on sanctions for a large American bank

Moving to a Perpetual KYC (pKYC) Model – the Benefits and the Challenges

What is the 50 percent rule? – FAQ and Everything you need to know

Absa finds an ally in AI for crime detection, reducing false positives by 77%

Cecabank revolutionizes retail and wholesale banking security

SymphonyAI announces KYC questionnaire and new identity management capabilities