Gaming

AML and fraud prevention for gaming

Don’t let criminals gamble your reputation. Ensure that you’re holding all the cards with complete AML and fraud prevention for online gaming.

Fraud prevention for global brands

Stack the gaming odds in your favor with enhanced risk management

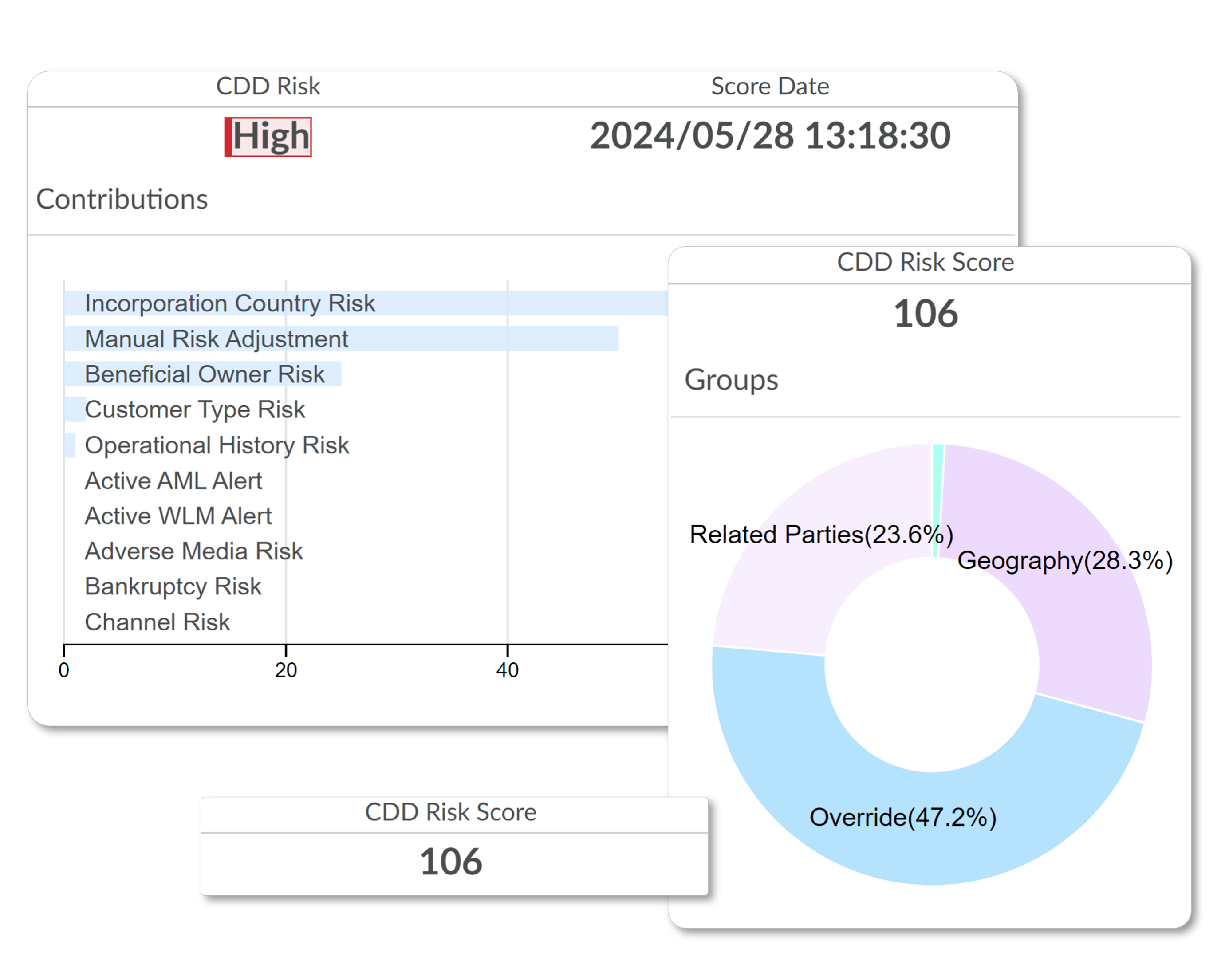

Protect the entire customer lifecycle with AI-driven detection that adapts to emerging criminal typologies, keeping you compliant, secure, and resilient against evolving threats.

Double down on due diligence for gaming

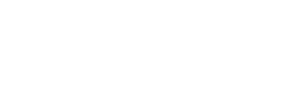

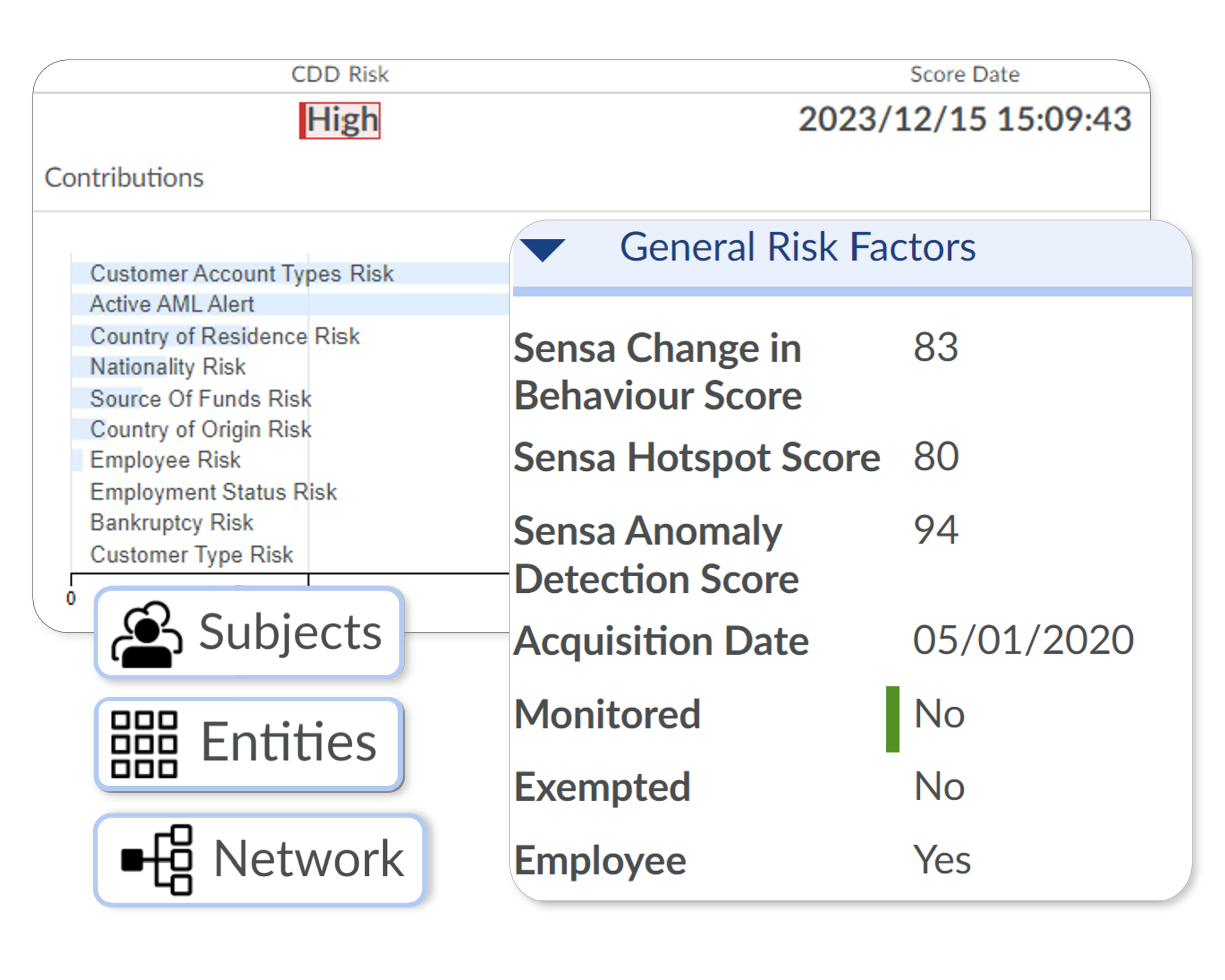

From real-time onboarding and risk scoring to ongoing event-driven KYC, ensure every customer’s risk is continuously monitored and managed in real-time.

Stay in control of gaming when regulators raise the stakes

Keep pace with ever-changing global regulations and complex cross-border gaming rules by easily adjusting compliance protocols based on location.

Don’t let gaming fraudsters stack the deck

Online gaming platforms face challenges like account takeovers and identity theft. With low latency interdiction on payments and advanced machine learning, we keep customers and platforms secure.

A sure bet for seamless integration

Our solutions are 100% data agnostic, meaning integration with Player Management Systems and payment processors and gateways are never an issue.

Explore our comprehensive range of financial crime prevention products

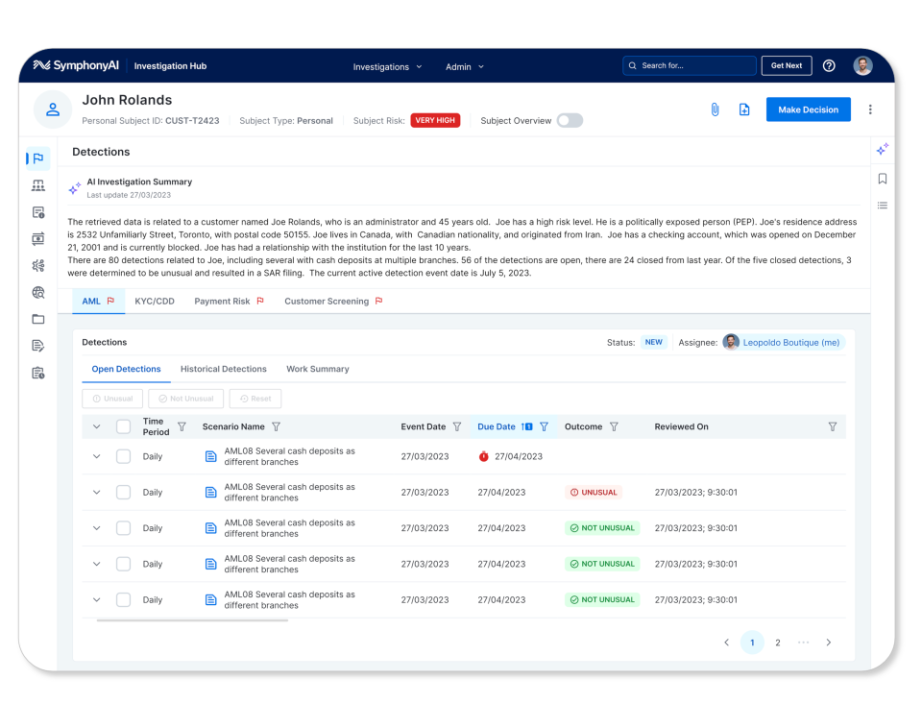

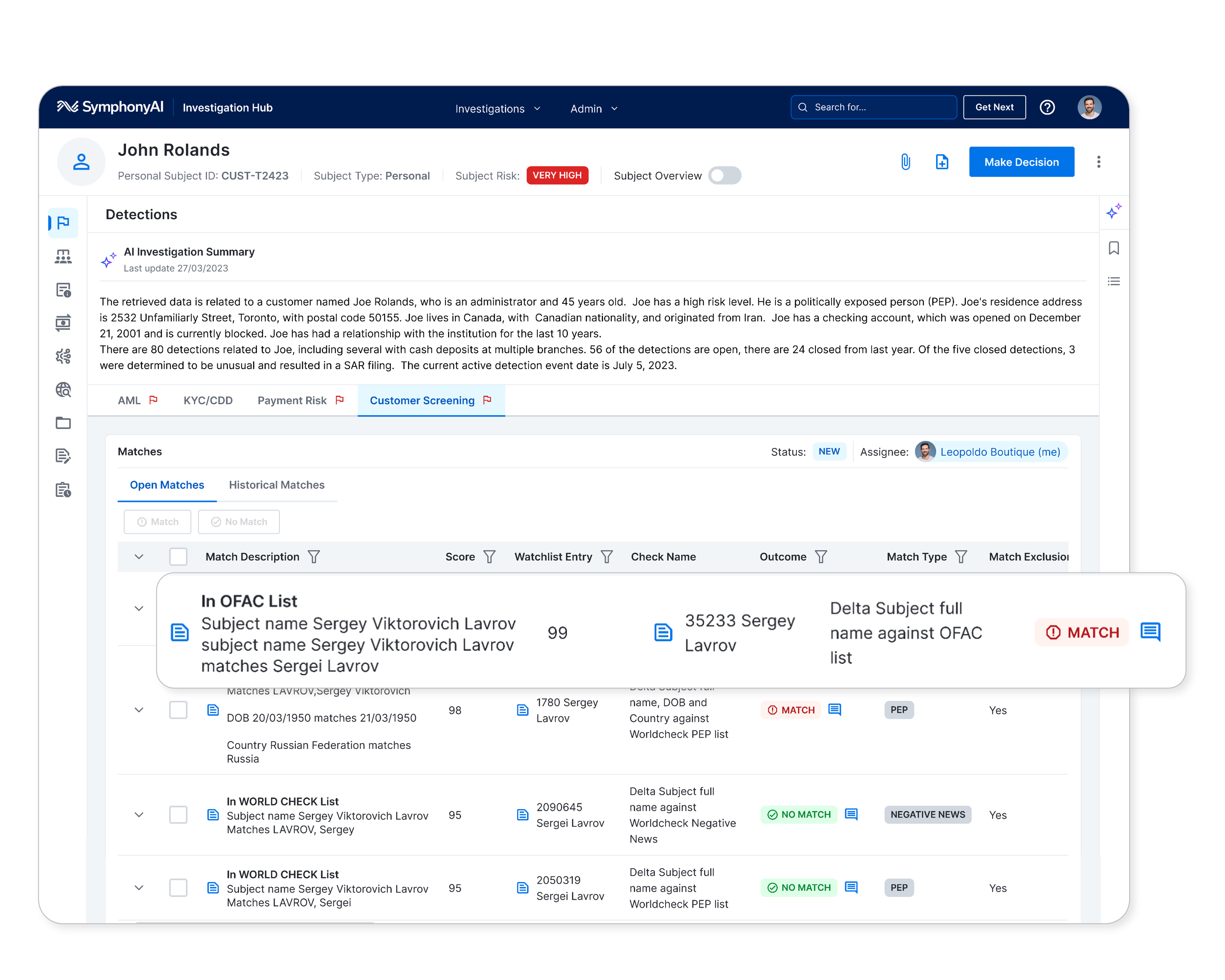

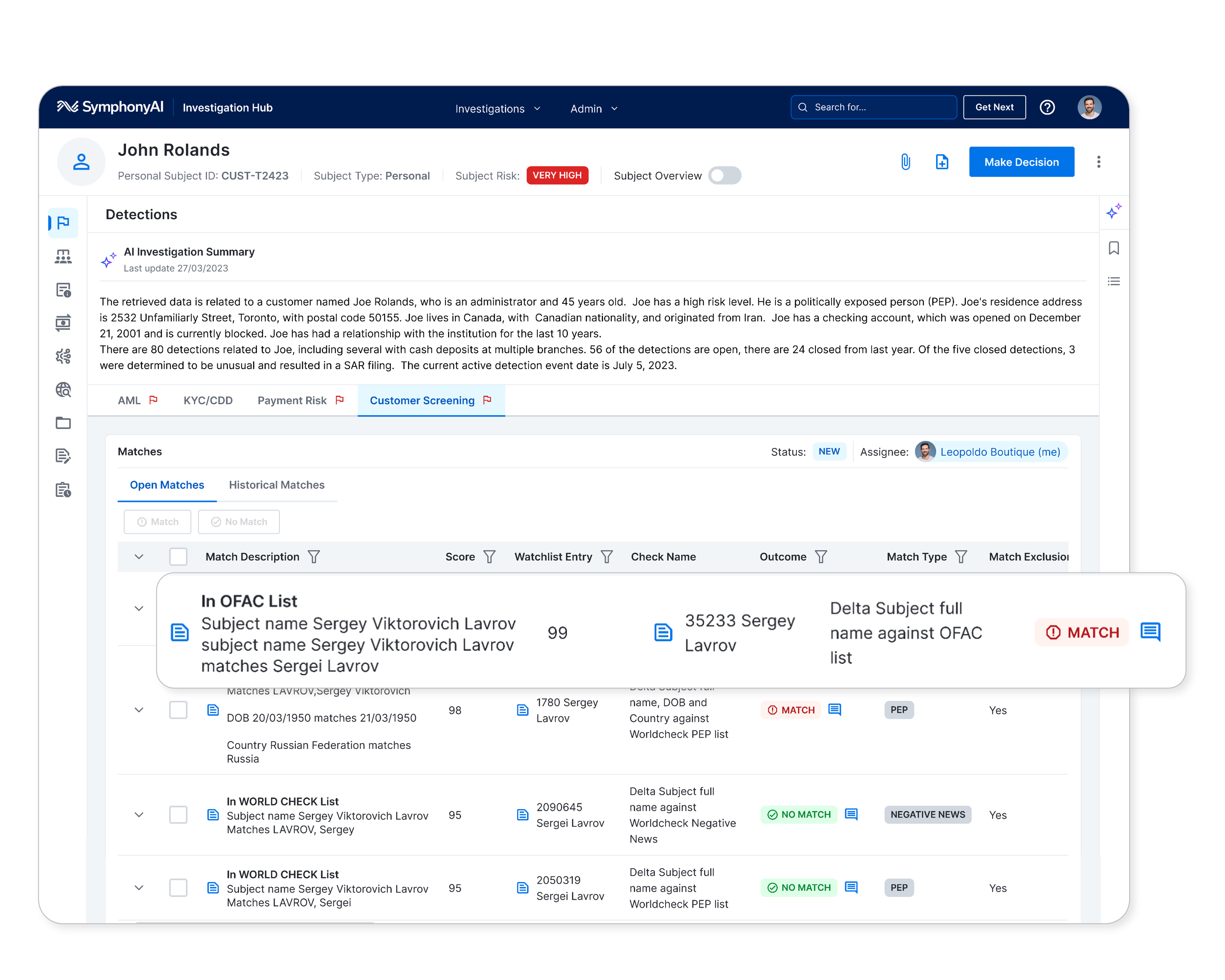

Streamline KYC/CDD operations with fully integrated, AI-driven NetReveal Name Screening. With extensive, flexible list integration, get real-time sanctions, PEP, and adverse media screening as standard to remove customer friction points, reduce false positives, and capture genuine risk.

- Screen against 350 supported watchlists in 60+ languages

- Enable real-time onboarding at scale

- Automate watchlist updates to support dynamic risk assessments

- Reduce false positives with superior matching accuracy

- Effortlessly scale to handle extreme volumes of data

Streamline KYC/CDD operations with fully integrated, AI-driven NetReveal Name Screening. With extensive, flexible list integration, get real-time sanctions, PEP, and adverse media screening as standard to remove customer friction points, reduce false positives, and capture genuine risk.

- Screen against 350 supported watchlists in 60+ languages

- Enable real-time onboarding at scale

- Automate watchlist updates to support dynamic risk assessments

- Reduce false positives with superior matching accuracy

- Effortlessly scale to handle extreme volumes of data

-

Latest news

-

BBK Enhances AML Efforts with SymphonyAI’s AI-Based Technology for Improved Compliance

12.09.2024 -

SymphonyAI announces partnership with Bank of Bahrain and Kuwait

12.04.2024 -

Bank of Bahrain and Kuwait implements SymphonyAI AML tech

12.04.2024 -

Bank of Bahrain and Kuwait Leads the Fight Against Financial Crime with SymphonyAI’s Best-in-Class AI-Based Anti-Money Laundering and Customer Due Diligence SaaS Products

12.03.2024

Gaming FAQs

The team at SymphonyAI is here to answer your questions about financial crime prevention and our solutions. Here are some of the most common.

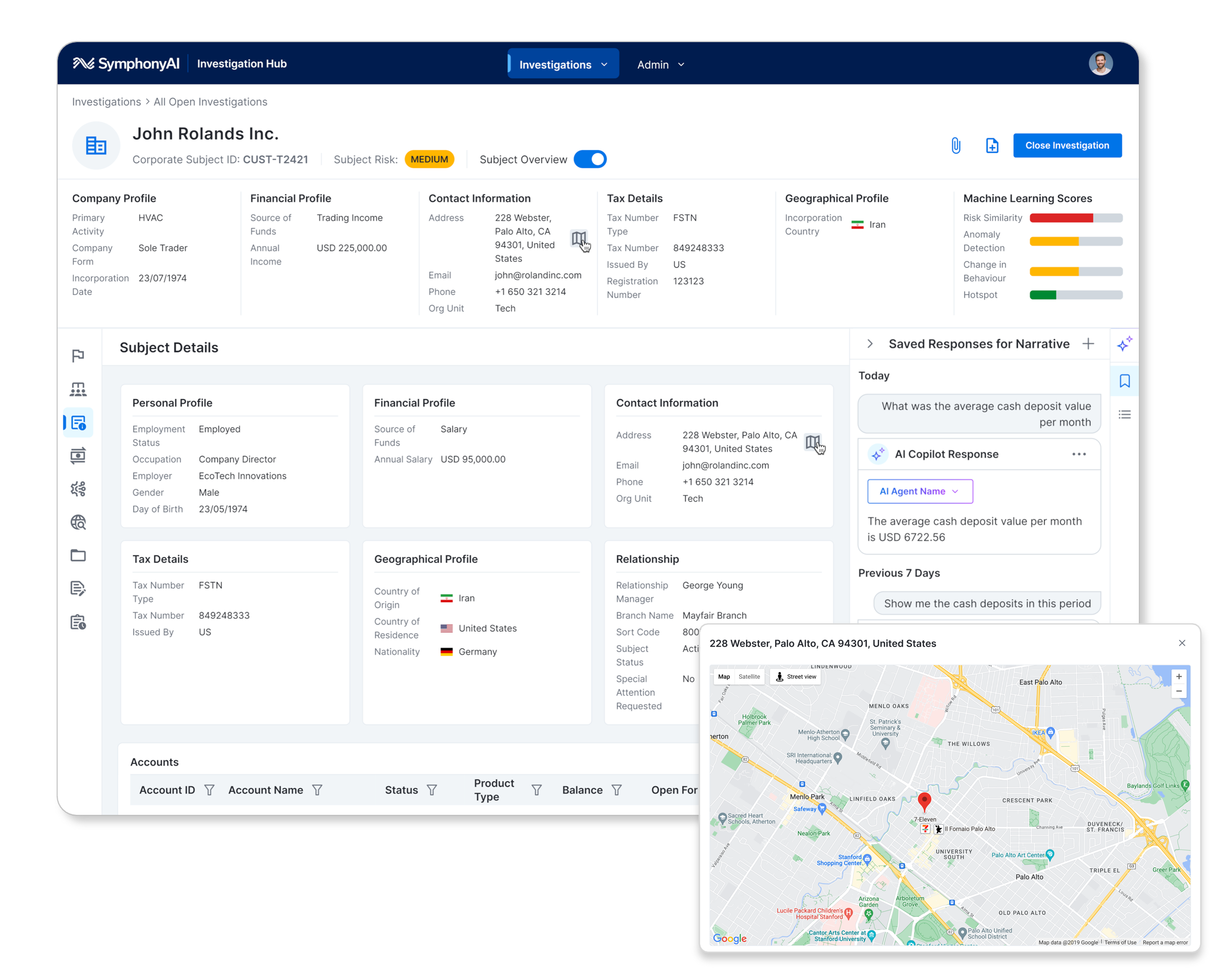

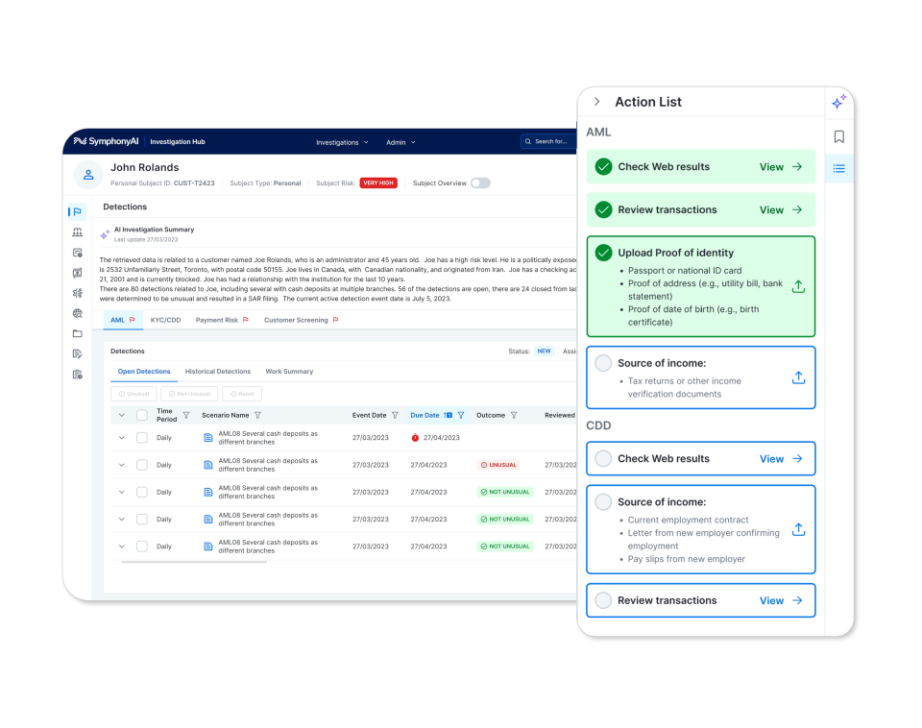

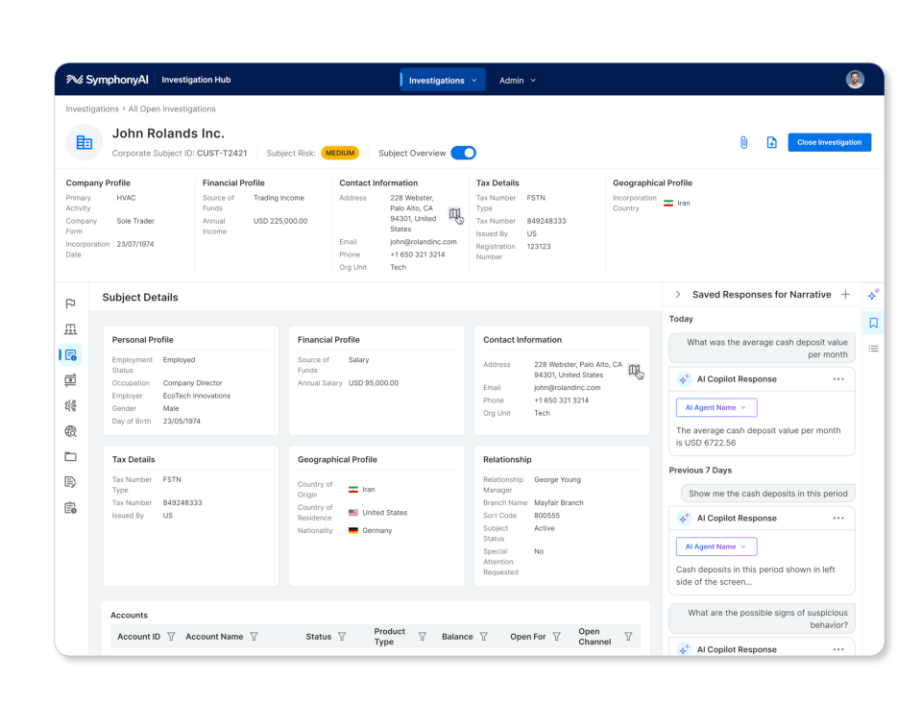

SymphonyAI offers AI-driven solutions to protect online gaming platforms from fraud and money laundering. These include tools for real-time onboarding, dynamic risk scoring, and continuous transaction monitoring to detect and mitigate evolving criminal threats.

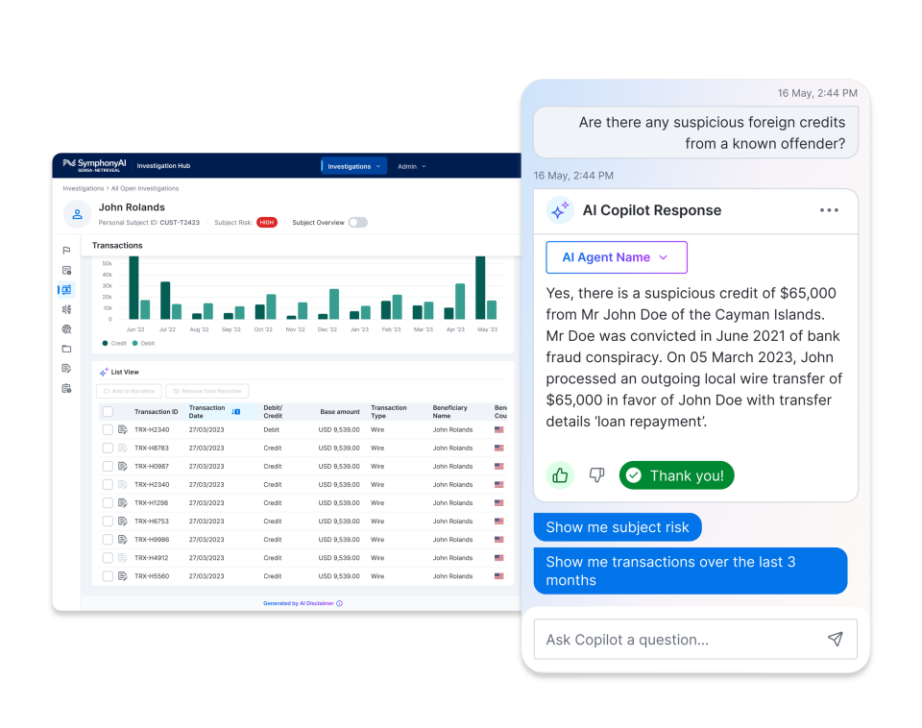

SymphonyAI’s gaming solutions combat challenges such as account takeovers, identity theft, and fraudulent transactions. The software leverages machine learning and low-latency interdiction to safeguard customer accounts and payment systems.

SymphonyAI helps gaming platforms navigate complex global regulations and cross-border rules. Its adaptable compliance protocols ensure alignment with location-specific requirements, making it easier to remain compliant with changing regulatory standards.

AI is central to SymphonyAI’s approach, enabling enhanced risk detection and real-time adaptability to new criminal typologies. Features such as automated watchlist updates and real-time sanctions screening ensure gaming platforms stay ahead of threats.

SymphonyAI’s solutions are fully data-agnostic, ensuring seamless integration with Player Management Systems, payment processors, and gateways, regardless of the platform’s existing infrastructure.

SymphonyAI offers:

- AI-driven Name Screening: Real-time sanctions, PEP, and adverse media screening with extensive watchlist coverage.

- Dynamic Risk Assessments: Automated updates to customer profiles for better risk management.

- Real-Time Onboarding: Scalable systems to handle high volumes with minimal friction.

The use of superior matching algorithms and advanced machine learning minimizes false positives, allowing compliance teams to focus on genuine threats and improving operational efficiency.

SymphonyAI combines AI-driven insights, seamless integration, and scalable operations to provide comprehensive protection against fraud and money laundering while ensuring a frictionless customer experience.