KYC CUSTOMER DUE DILIGENCE

Empower faster decision-making

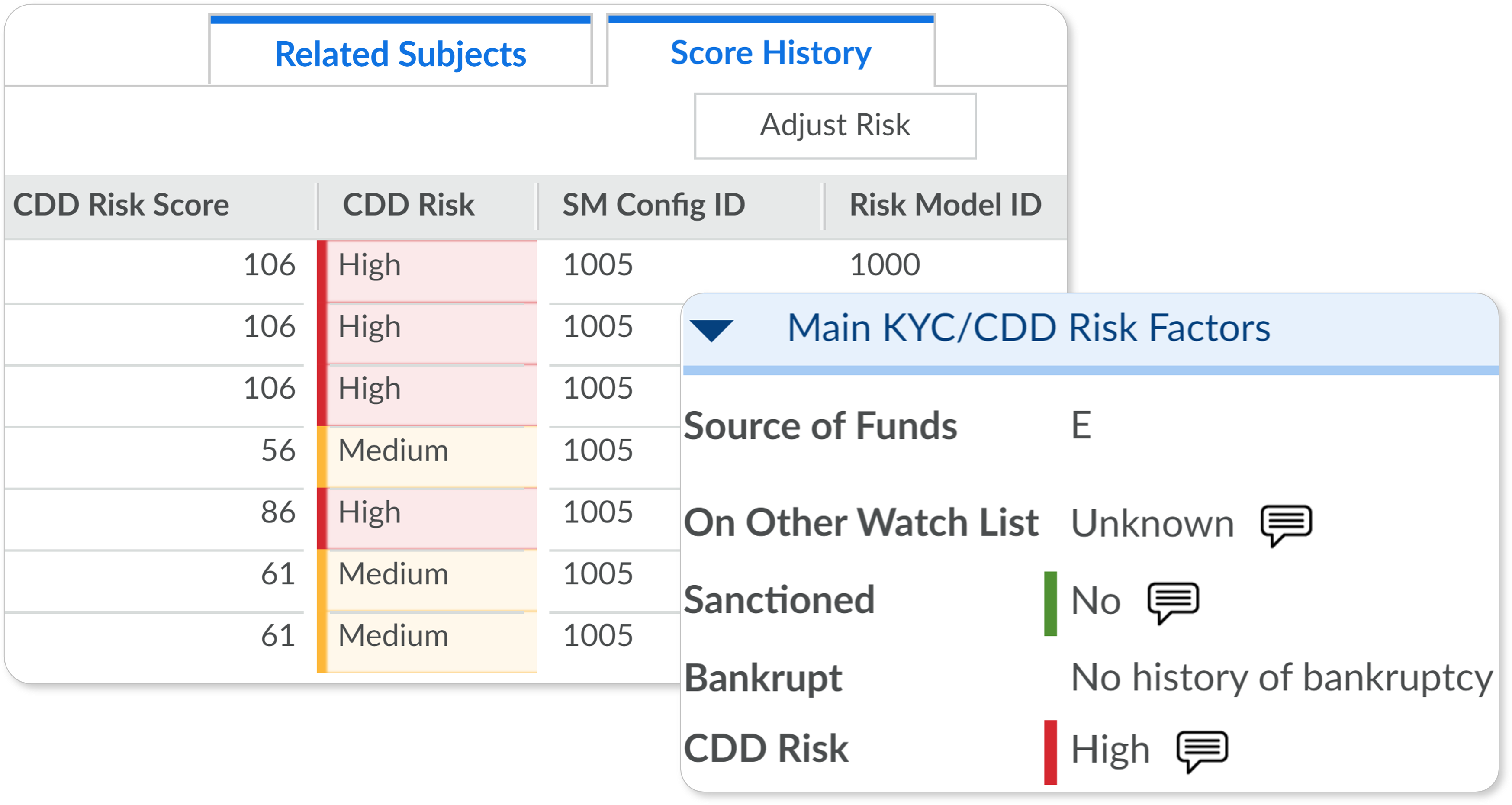

Enable effective risk assessment decisions without the legwork

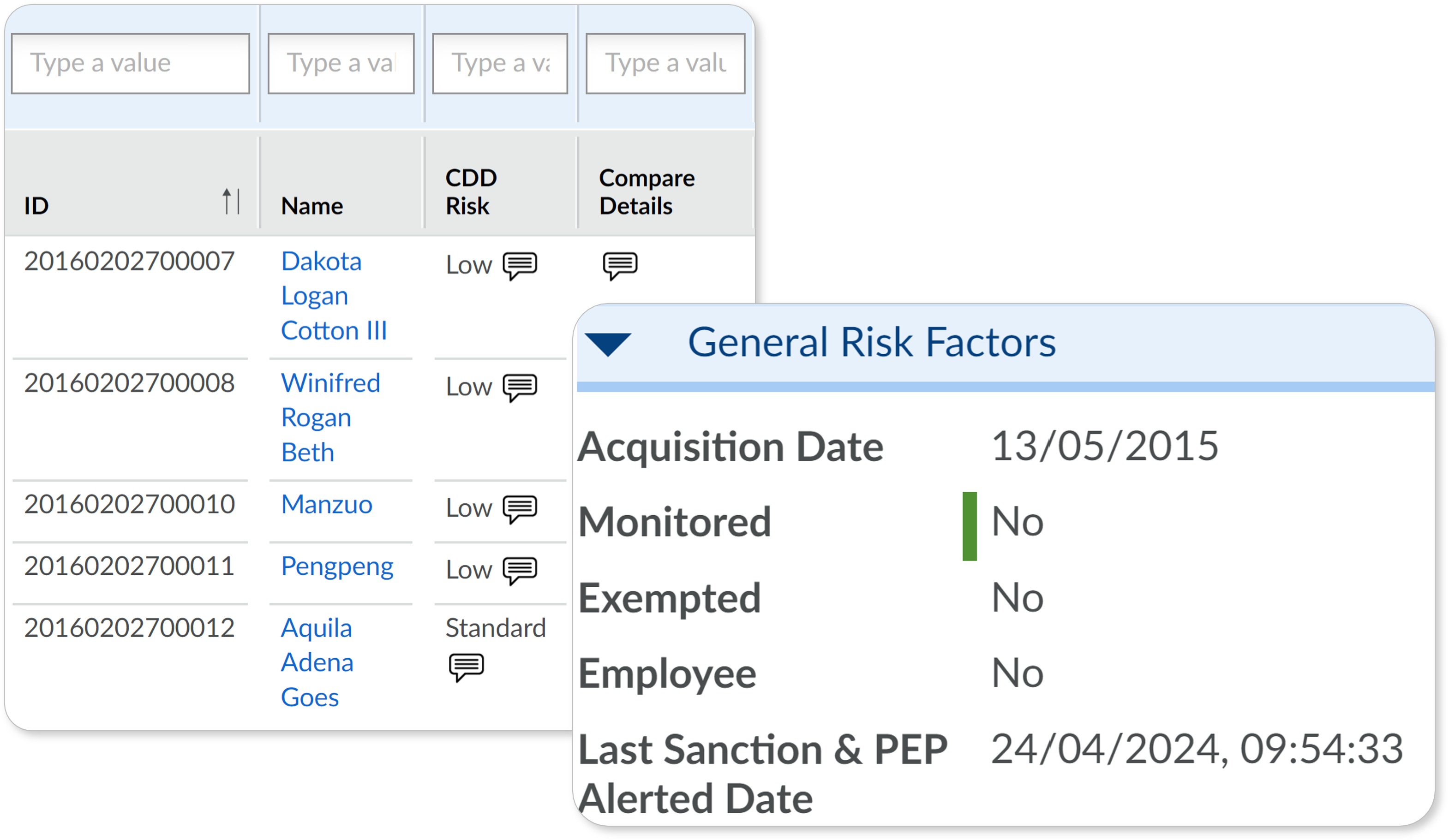

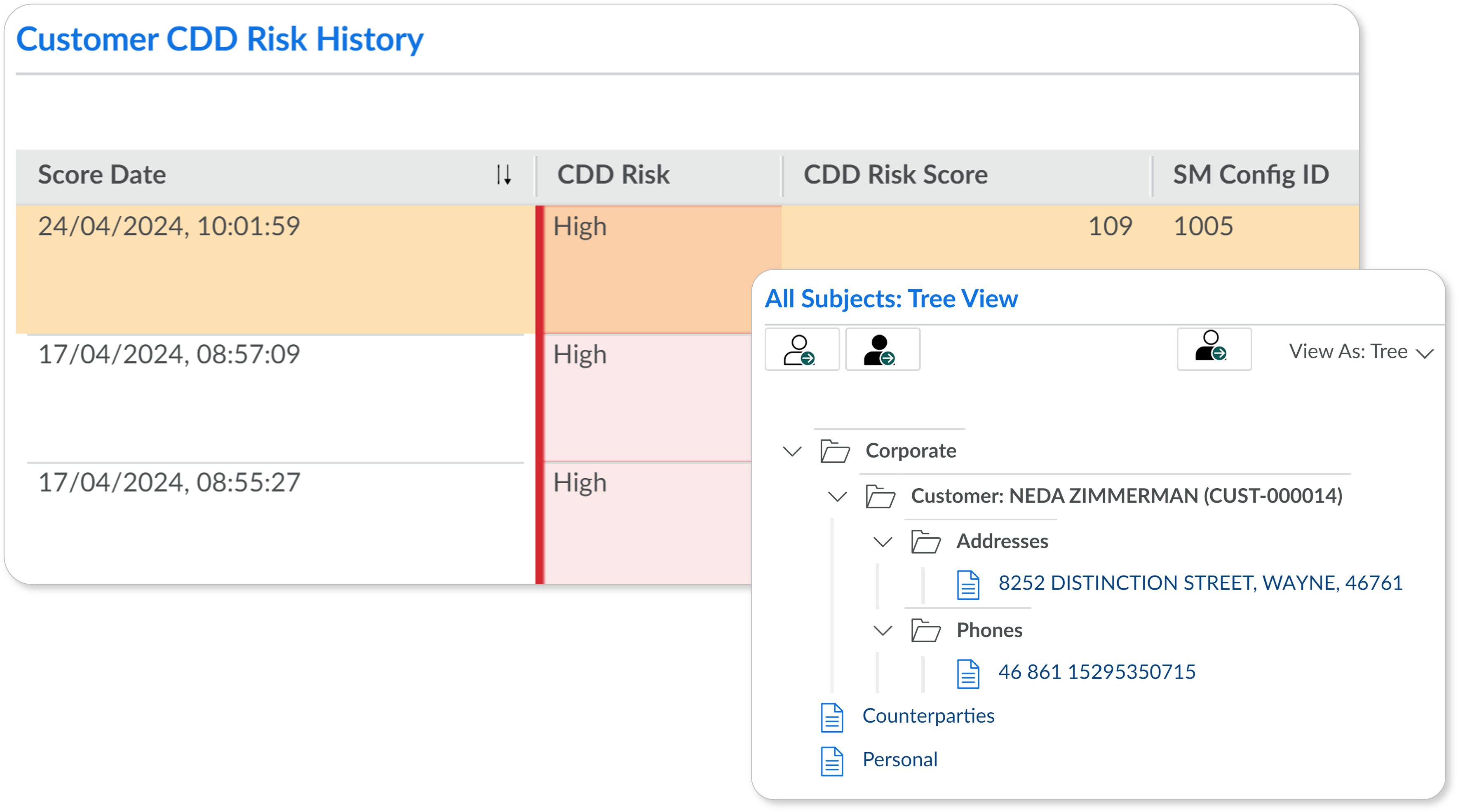

See the bigger picture

Improve investigator efficiency by up to 40% with a centralized 360° view of all alerts relating to an entity in a single screen.

Eliminate level 1 triage

Automate the first line of triage with machine learning models that prioritize high-risk alerts while auto-hibernating known false positives.

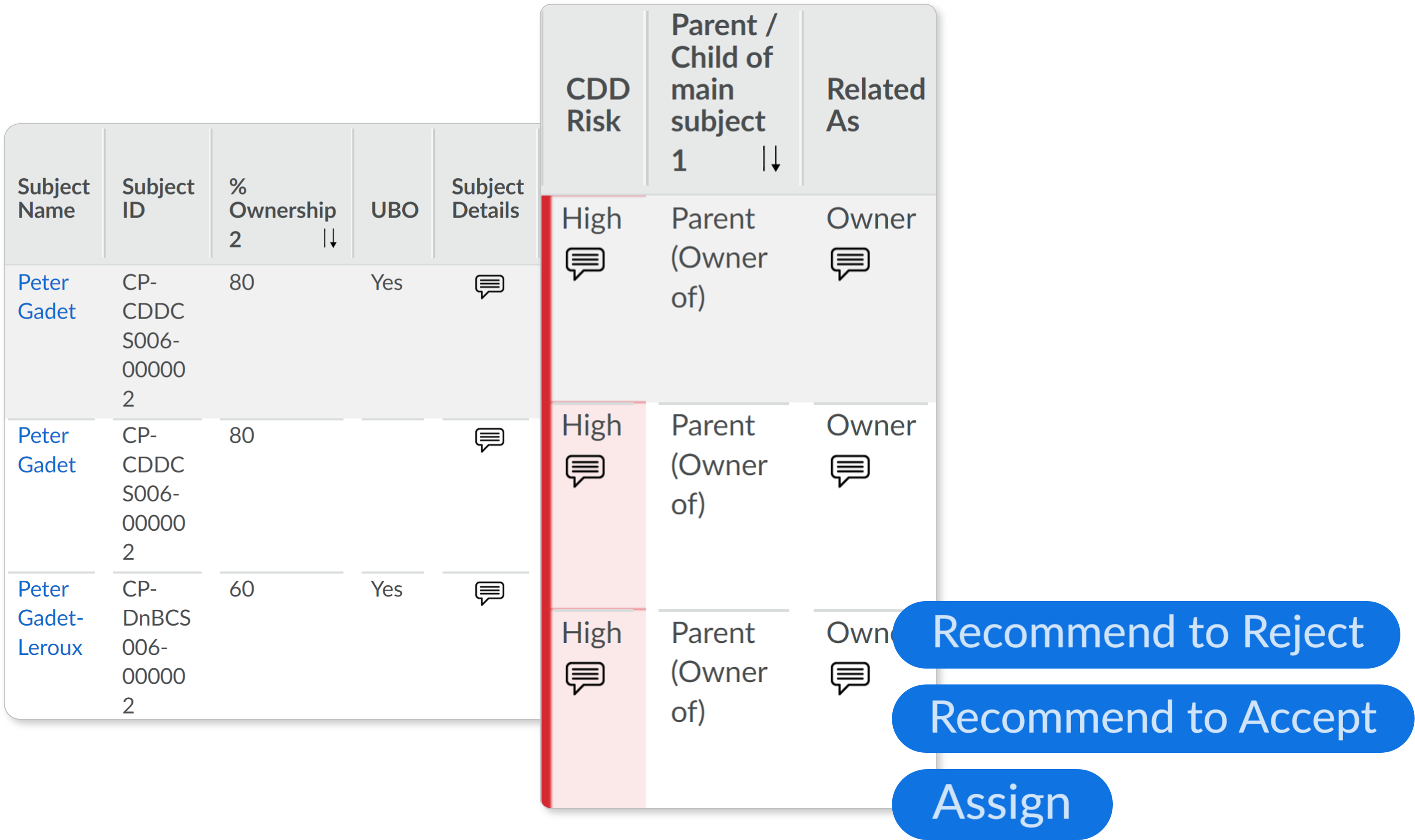

Automate workflows

Maximize productivity with a library of automated workflows to eliminate manual tasks, enabling investigators to focus on effective risk assessments.

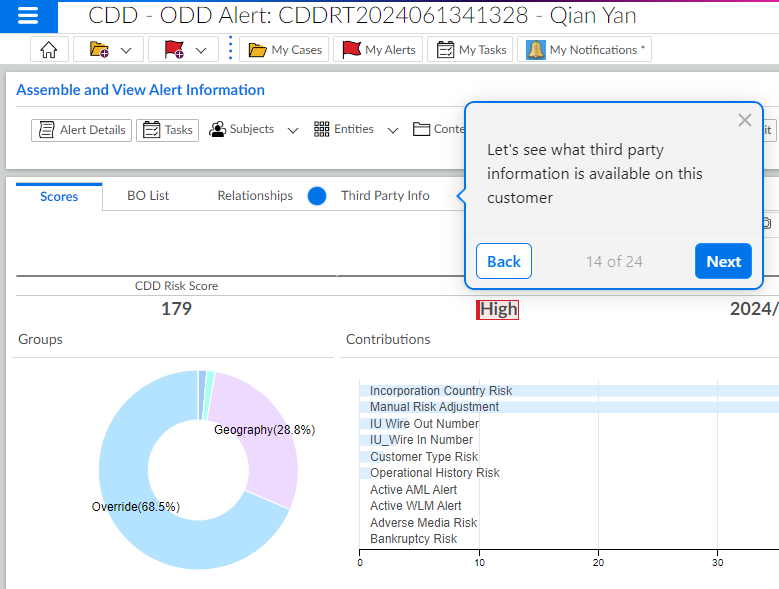

Automate data collection

Remove the need for manual data collection with auto-enriched customer risk data provided for every alert enabling faster decision-making.

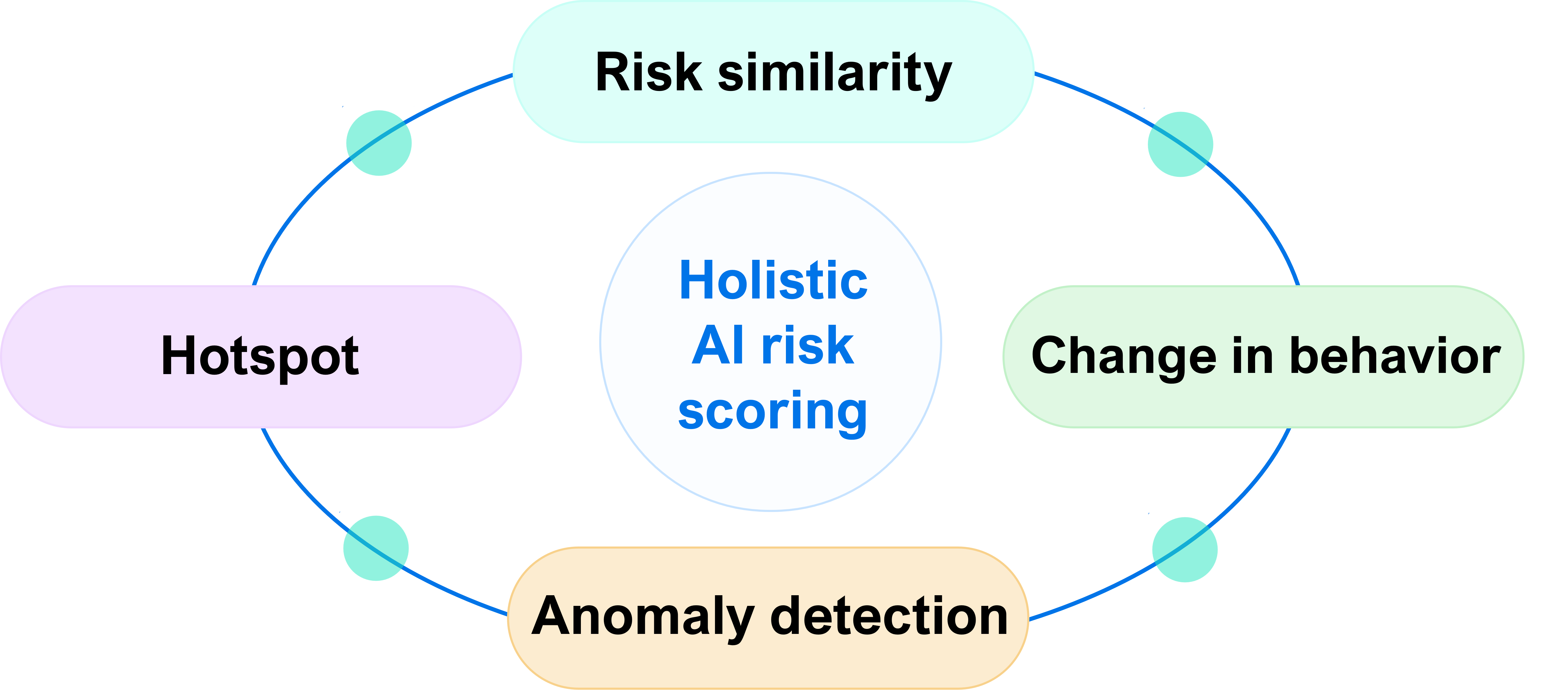

SensaAI for AML

Enhance KYC even further with an AI augmentation

Enable more effective ongoing risk assessments with powerful AI models that identify when customer activity does not align with expected behavior. The easiest way to connect AML with CDD for fast, effective results.

Discover more features and functionality of NetReveal Customer Due Diligence

Solution benefits

Onboard and detect risk in real-time

Accelerate CDD and automate complex tasks to improve the customer experience.

Manage risk intelligently

Consolidate all customer data and gain a single, holistic view of a customer’s risk profile.

Remain compliant

Ensure adherence to ever-evolving regulatory directives and quickly adapt to changing requirements.

Customize with ease

Quickly adjust UBO thresholds to align with regulatory mandates and your risk appetite.

Related resources

-

Blog

All bets are off: money laundering risks in the gaming industry

Financial Services -

Analyst report

AI-enabled Financial Crime Compliance Transformation in Asia

Financial Services -

Blog

ACAMS Las Vegas 2024: AI Takes Center Stage in Financial Crime Prevention

Financial Services -

Blog

How to use AI and communication to break down data silos in financial crime prevention

Financial Services