AI AUGMENTATIONS

Upgrade your compliance stack with AI—don’t replace it

Strengthen your operations—without the tech stack rip-and-replace—with financial crime prevention AI augmentations from SymphonyAI.

AI augmentation for global brands

-

80%

False positive reduction

-

70%

Faster investigations

-

30%

More SAR-worthy risks detected

Transform your capabilities by upgrading your existing stack

Legacy tech stacks are hard to replace, inefficient, and can’t keep pace with evolving risk. SymphonyAI’s AI augmentations support investigators with a unified picture of evolving risk—before it becomes problematic.

Avoid a complete overhaul of your legacy solutions with AI augmentations that strengthen them. SymphonyAI’s SensaAI enhances rules-based detection methods with powerful AI.

Outpace regulations and demonstrate compliance with clear and simplified workflows, reporting, and models. SymphonyAI’s solutions evolve with mandates and your risk appetite.

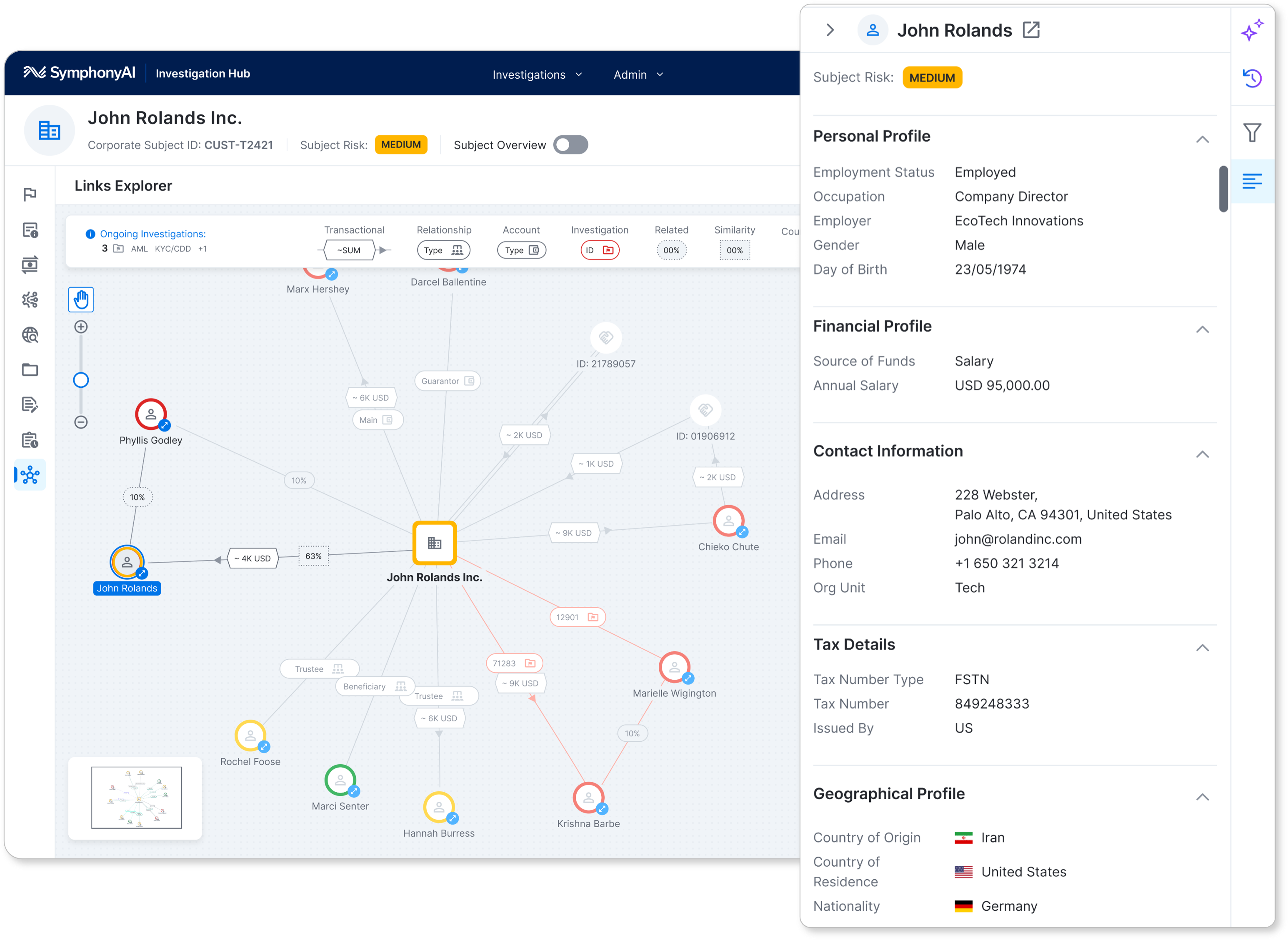

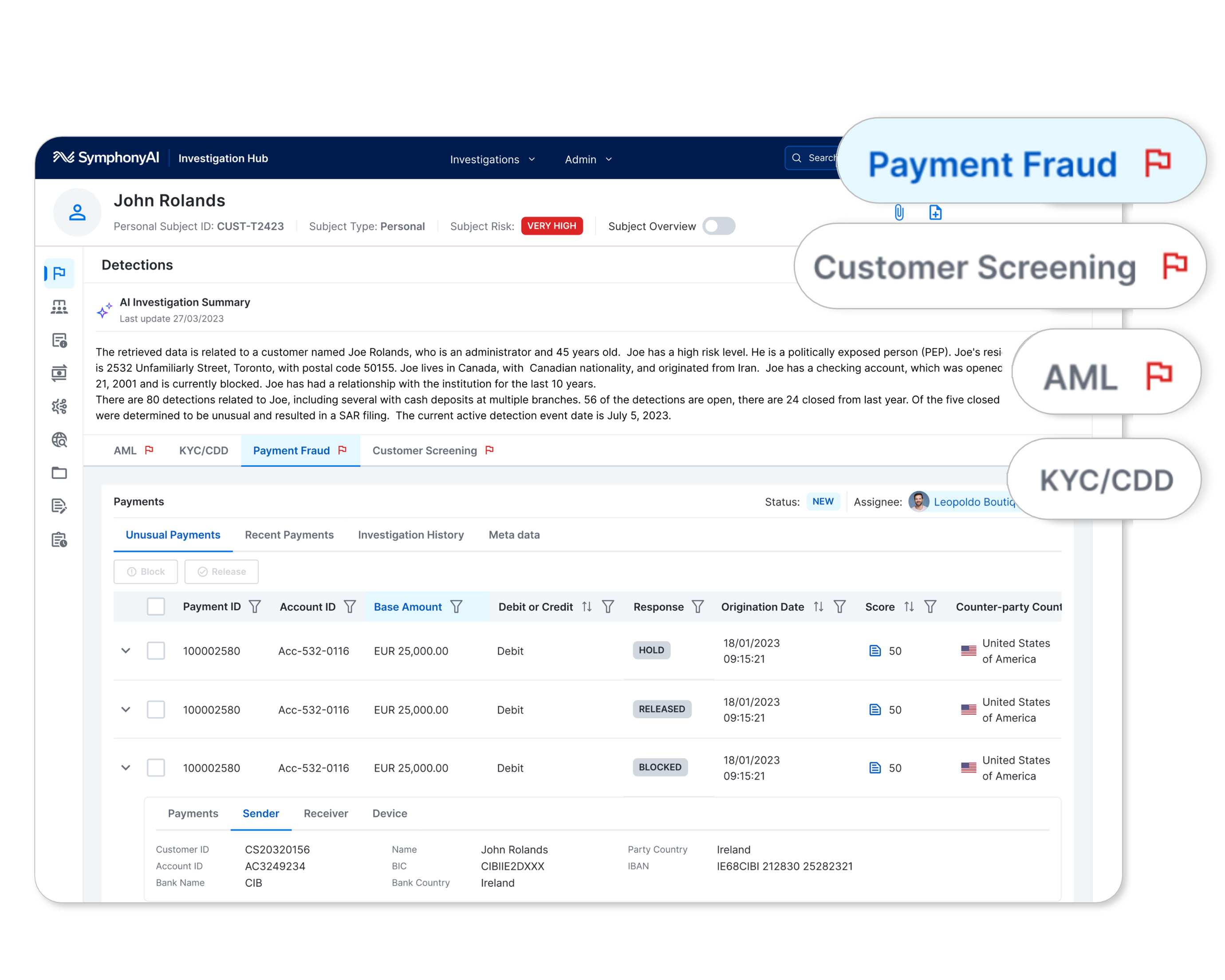

Enable investigators to make efficient decisions based on intelligent information. SymphonyAI’s solutions reduce the burden of false alarms from outdated detection capabilities.

Navigate organizational complexities with a cohesive strategy. SymphonyAI’s solutions support your business with a single, enterprise-wide deployment of AI augmentations.

AI augmentation products to support financial crime prevention

Boost matching accuracy with the combined power of predictive and generative AI that enhance your screening capabilities—without replacing in-place tech. SensaAI for Sanctions gives your existing sanctions screening software an upgrade.

SymphonyAI’s Sensa AI for Sanctions is a pre-trained, out-of-the-box solution that realizes immediate results. Reduce false positives by 80% while retaining 100% of your true positives. Detect new hidden risk in unstructured data, prioritize high-risk alerts, automate level 1 triage, and provide necessary context to investigators.

Boost matching accuracy with the combined power of predictive and generative AI that enhance your screening capabilities—without replacing in-place tech. SensaAI for Sanctions gives your existing sanctions screening software an upgrade.

SymphonyAI’s Sensa AI for Sanctions is a pre-trained, out-of-the-box solution that realizes immediate results. Reduce false positives by 80% while retaining 100% of your true positives. Detect new hidden risk in unstructured data, prioritize high-risk alerts, automate level 1 triage, and provide necessary context to investigators.

AI augmentations—unmatched, expert support

Utilize our deep domain knowledge to protect your customers

With 25+ years of experience developing financial crime prevention solutions, SymphonyAI is a partner to the world’s leading financial institutions.

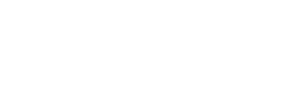

Investigate and understand the full customer lifecycle

Easily cover the complete customer lifecycle and integrate your data with a single solution for your entire compliance ecosystem.

Transform your capabilities with predictive and generative AI

Enhance your detection and investigation capabilities with industry-leading predictive and generative AI, and supervised and unsupervised machine learning.

Connect enterprise-wide units and data in AI-driven solutions

Tear down the silos that inhibit investigators with complete, scalable sanctions screening and anti-money laundering solutions for your entire organization.

Customer success is our success

Industry awards

Employ end-to-end financial crime prevention—scalable to your needs

Discover the value of SymphonyAI

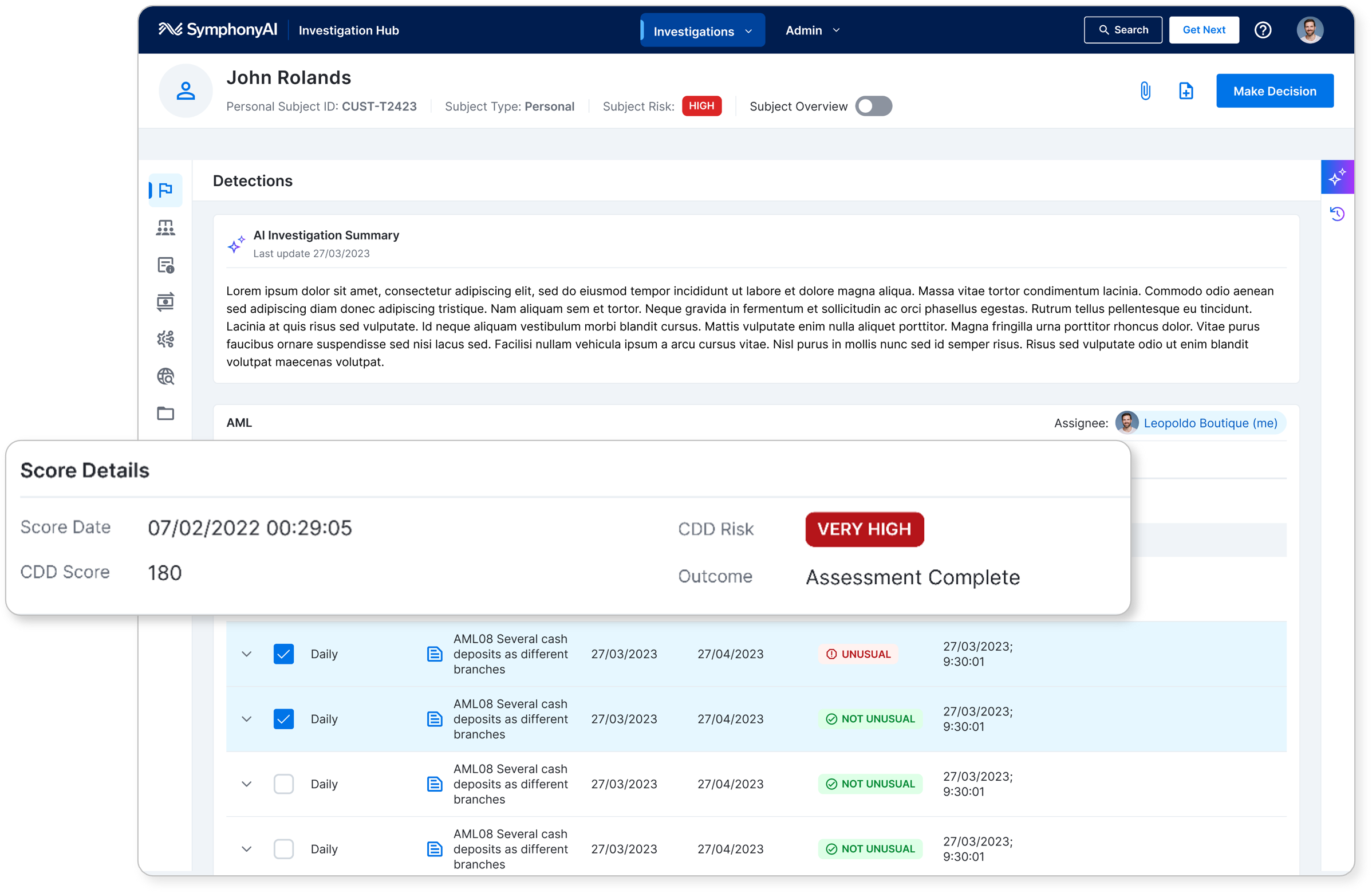

Strengthen your case management capabilities with AI-driven financial crime prevention solutions—backed by support from strategic experts.

Augmentations FAQs

The team at SymphonyAI is here to answer your questions about financial crime prevention and our solutions. Here are some of the most common.

SymphonyAI provides AI-powered augmentations that enhance existing compliance systems without needing a full tech replacement, improving detection and investigation for financial crime prevention. These includes SensaAI for AML and SensaAI for Sanctions.

Yes, the AI-driven solution SensaAI for AML reduces false positives by up to 80%, improves investigation speed by 70%, and detects up to 30% more suspicious activity reports (SAR)-worthy risks, allowing investigators to act faster with higher accuracy.

SymphonyAI’s overlays are designed to work with existing tech stacks, minimizing disruption while enhancing rules-based detection methods with predictive and generative AI to detect previously hidden risks.

Yes, the SensaAI for Sanctions solution upgrades existing sanctions screening systems, reducing false positives and enhancing true positive detection, with features like real-time alerts, automated triage, and contextual data insights.

SymphonyAI’s overlays are pre-trained, out-of-the-box solutions that deploy rapidly, allowing institutions to see immediate improvements in fraud detection and compliance management.

Clients such as large banks like Absa have reported reductions in false positives by up to 77% using SensaAI for AML, improved risk assessment capabilities, and millions saved annually by integrating SymphonyAI’s AI augmentations with their compliance stacks. Absa’s use of SensaAI for AML saw them win an ICA Compliance Award.