Accurately forecasting demand and making effective replenishment, fulfillment and category planning decisions is challenging enough when market conditions are stable. Doing so during a pandemic filled with supply chain disruptions, labor challenges and rates of inflation not seen for decades takes the degree of difficulty to another level.

The circumstances retailers and CPGs faced the past two years meant that many important decisions were based on instinct versus insights, and historical data was of little help. This is especially true now when it comes to the conversation on inflation. Upstream in the supply chain, CPGs have faced all manner of increased input costs, which saw them push through price increases to retailers. Retailers then had to make hard choices to increase prices to maintain margins, while working to remain competitive and still deliver value for shoppers. Complicating these choices further has been the reality that decades of benign inflation had allowed flawed assumptions to creep into the retail psyche regarding shoppers’ price sensitivity, willingness to trade down and responsiveness to promotions.

These assumptions emerged decades earlier when retailers and CPGs faced similarly high rates of inflation but lacked the AI capabilities to uncover insights waiting to be freed from the data. We know this because SymphonyAI undertook a major research initiative in which we turned AI loose on 2.2 billion shopper transactions over a 12-month period spanning the latter half of 2020 and the first half of 2021. Key insights were contained in our 2021 Shopper Study: The Changing Customer Landscape, and that analysis led to a more recent deeper dive into the fresh department.

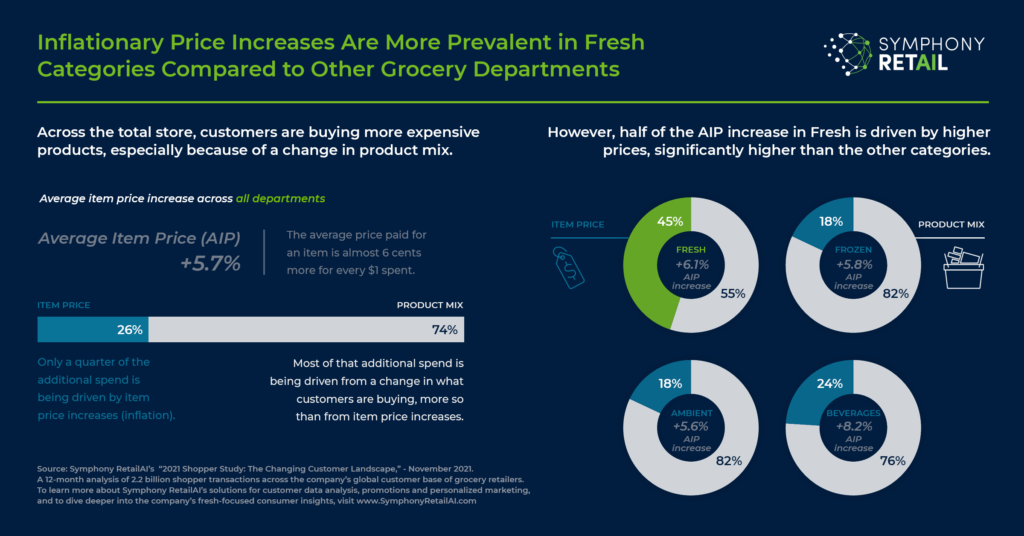

We looked at underperforming categories, key shopper segments and how inflation impacts sales of fresh items. In doing so, we discovered the following:

- Inflation is observed to be more pronounced in fresh categories than other grocery departments, but that didn’t discourage shoppers. Fresh items make up nearly half of shoppers’ baskets.

- Fresh is more important than ever. Shoppers on average had seven times more fresh items in their basket (43%) than frozen items (6%) and considerably more than shelf-stable products (29%).Shoppers spent more across all departments, but a much larger portion of price increases for fresh items was due to inflation, whereas in other categories average item price (AIP) increases more often resulted from shoppers choosing more expensive or premium options.

- Nearly half of the AIP increase in fresh was driven by inflation, compared to frozen, ambient and beverage categories, where inflation accounted for less than a quarter of the price increase.

- Fresh gained new importance as a traffic driver. Looking at monthly purchase frequency, fresh (24.8%) is purchased more often than ambient products (22.5%), but twice as often as frozen (11.1%). Fresh categories also saw 8% growth in shopper households during the study period, the highest rate of growth compared to ambient, beverages and frozen.

In addition to these high-level insights – which only scratched the surface of AI’s ability to enable customer-centric insights for grocers – another key takeaway concerned price-sensitive shoppers and grocers’ market share. Inflation observed during the 2020-2021 period of analysis showed traditional grocers lost shoppers in the fresh categories of meat, poultry and dairy. Grocers underperformed in these areas with price-sensitive shoppers, highlighting the need for a comprehensive view of shopper behavior throughout the store to inform optimal decisions around price and promotion. Prior generations of grocers understood this concept instinctively when encountering high periods of inflation, but back then they lacked the technology and tools available to today’s grocers.

That’s no longer the case. If fact, by comparison, the decision-making capabilities available to modern grocers is stunning, relative to operators who had to cope with inflationary pressures in the 1970s or 80s. This is especially evident when it comes to understanding the impact of inflation by product, by category and by shopper segment across a retailer’s operating regions, districts or store clusters.

Armed with such understanding, retailers can adjust item and category strategies based on the importance of price or promotions to a given customer segment. If an item is extremely important to price-sensitive customers, the retailer can make strategic category management and promotional decisions to offset any lost perception of value and further drive traffic and sales.

Perceptions of value and how those perceptions are established through strategic category management actions, especially in fresh, will remain a huge issue in 2022. The trend of elevated inflation is expected to linger, for a variety of reasons that will be the source of endless debate. However, for retailers the root causes of inflation are ultimately irrelevant. They must play the hand they have been dealt, whether that is during an inflationary period or some other type of marketplace volatility. What our recent analysis of 2.2 billion transactions shows is retailers who have AI on their side greatly improve the odds of winning with shoppers.

We invite you to visualize what our data showed about inflation in fresh.

The numbers from our study of shopper data certainly tell a story, but the data is most impactful when the comparisons are seen side by side, with fresh compared to other categories, as illustrated here.

Want to learn more? Connect with a solution consultant.